Demand Surges for Bonds Which Protect Against Rating Downgrades As Covid-19 wave threatens outlook for businesses: India Credit

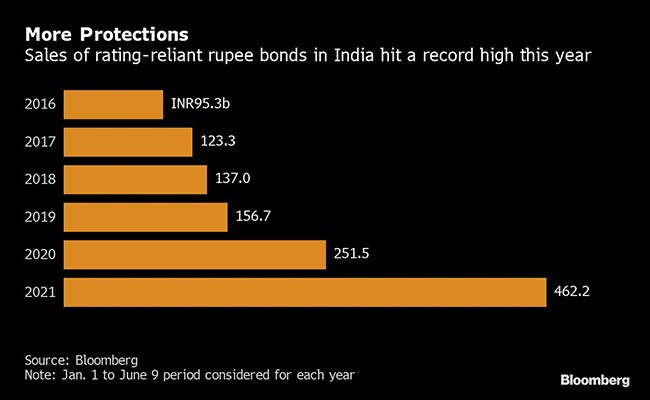

Issuance of such bonds has jumped to a record Rs 462.2 billion ($6.3 billion) so far this year

Investors in local-currency notes are demanding more protection than ever as the world’s worst Covid-19 wave threatens the outlook for businesses.

- Bondholders are piling into rupee-denominated debt whose interest increases every time the notes’ credit ratings are downgraded.

- Issuance of such bonds has jumped to a record Rs 462.2 billion ($6.3 billion) so far this year, compared with Rs 251.5 billion a year earlier, Bloomberg-compiled data show.

- An example is debt sold in May by Godrej Industries, part of one of India’s oldest conglomerates.

Those AA rated securities have a clause that the 6.92 per cent coupon would be raised by 25 basis points for each step of a rating downgrade below AA-, though the interest moves back to earlier levels if it’s upgraded again; there have been no rating changes since issuance

- These bonds with so-called credit rating protection metrics can benefit issuers as well in some cases; that’s because just as they promise to pay more in case of a downgrade, some notes let companies lower coupons if their bond grades are raised

- Massive stimulus has helped boost upgrades to 131 versus 128 downgrades this year based on Crisil ratings. That’s better than a year earlier when it was 237 versus 984

- But concerns are spreading again. The Reserve Bank of India last week joined economists in cutting the nation’s growth forecast for this financial year to a single digit from double digits previously

Primary Market — Sales Slow

- In India’s onshore debt market, fewer borrowers are seeking bids this week for rupee bonds after strong issuance last week left little

- Local firms haven’t raised a penny through rupee notes as of Wednesday. As much as Rs 13.5 billion are expected to be raised in the remaining week. That would be significantly lower than a six-week high of Rs 126.3 billion issued last week

- Axis Bank, India’s biggest rupee corporate bond arranger since 2007, advises companies that require long-term funding to access the markets now as borrowing costs remain low

- In the overseas market, TML Holdings Pte sold a dollar bond last week after Indian company notes in the U.S. currency posted their biggest monthly returns of 2021 in May. The issuance is only the second dollar offering from India this quarter and a stark contrast with a record $12.7 billion in the first quarter.

Secondary Market — Tightening Seen

- Axis Bank’s senior dollar bonds may tighten about 25-30 basis points versus Bank of Baroda and Canara Bank’s notes on stronger capital, better profitability and lower asset-quality pressure, Bloomberg Intelligence analysts Rena Kwok and Sheenu Gupta said in a note.

Distressed Debt — Some Resolutions

- India’s bankruptcy court allowed billionaire Anil Agarwal’s Twin Star Technologies to take over Videocon Industries. Twin Star will pay about Rs 30 billion to Videocon’s lenders.

- A bankruptcy court in Mumbai approved Piramal Enterprises’ unit to acquire shadow lender Dewan Housing Finance Corp. Court rejected DHFL founder Kapil Wadhawan’s application to settle the dues and close the bankruptcy case

- Moody’s Investors Service local unit ICRA expects the second wave of the virus pandemic in India could delay insolvency recoveries and increase creditor losses

- Franklin Templeton plans to appeal a ruling by India’s market regulator after the money manager’s local unit was barred for two years from offering new debt funds

Credit Rating — Fallen Angel Risk

- Adani Ports faces fallen-angel risks — dropping to junk grade from investment level — due to India’s weakening macro conditions while its ratings headroom on a standalone basis has also been eroded by recent acquisitions, said Sharon Chen, analyst at Bloomberg Intelligence

S&P expects no change in India’s sovereign ranking over the next two years, the credit assessor said in May as it cut its forecast for the nation’s economic growth to below 10 per cent

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)

Source link