Renting Is Cheaper Than Buying, Almost Everywhere

Rent or buy? For those with a choice, there’s a lot to consider. Renting doesn’t tie you down, nor does it require a huge down payment. On the other hand, buying can be a profitable long-term investment with tax benefits. And let’s not underestimate the peace of mind that comes from knowing that your home won’t be pulled out from under you by a landlord.

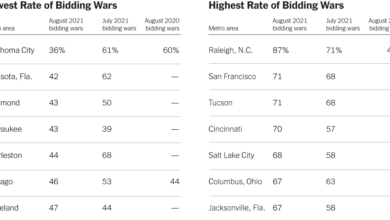

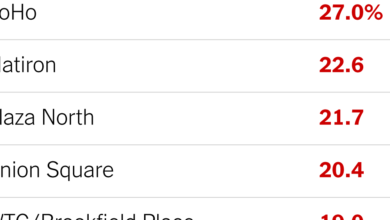

The choice, however, is almost always about money, and in today’s hot seller’s market, a lack of available homes and skyrocketing prices have stymied many aspiring buyers. The flip side has been falling rents, especially in cities, where landlords struggle to fill record numbers of vacant apartments by offering rent cuts and concessions. Although rents show signs of recovering, it’s still a good time to sign a lease.

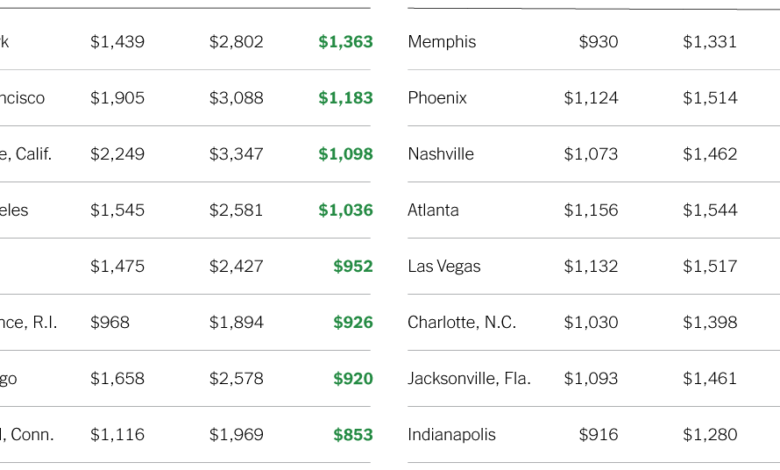

A recent study by LendingTree found that median housing costs were lower for renters than for homeowners with a mortgage in all 50 of the largest U.S. metro areas. The greatest difference between the median rent and the median cost of owning a home with a mortgage was in New York City, at $1,363 a month. San Francisco and San Jose, Calif., were next, with the gap between renting and owning exceeding $1,000.

To reach its conclusions, LendingTree compared median rents and mortgaged housing costs using data from the Census Bureau. This week’s chart shows the 10 metro areas with the largest and the smallest differences in housing costs for renters and owners.

Source link