Around the World, Buying Is Costlier Than Renting

[ad_1]

In today’s tight, competitive housing market, the first hurdle for many aspiring home buyers is simply being able to afford one. After all, a rent check is usually smaller than a mortgage payment on a comparable property. For those looking to buy a home overseas, the hurdles can get even higher.

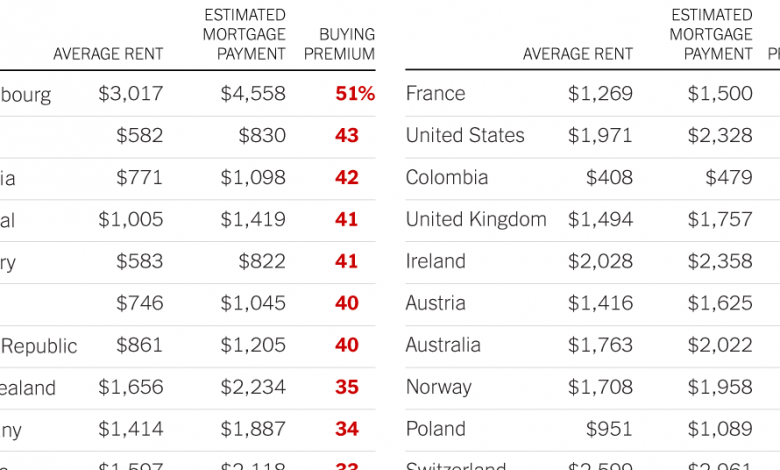

A new study by Comparethemarket.com, a website that helps consumers compare costs of home loans and other products, weighs the pros and cons of buying or renting in 39 countries around the globe by examining each location’s average monthly cost of renting a three-bedroom home, the estimated mortgage payment on a three-bedroom home, and the monthly premium that buyers can expect to pay over renters. Data was captured in the fourth quarter of 2020 and drawn from the Organization for Economic Cooperation and Development, a Paris-based think tank whose member nations cooperate to develop economic and social policy; and Numbeo, an online database that specializes in the cost of living.

[Curious about homes in distant lands? Read our International Real Estate column.]

Among the nations included, tiny Luxembourg had the highest mortgage premium, with the estimated monthly mortgage of $4,558 sitting about 50 percent higher than the average rent of $3,917. Next was Latvia, where the mortgage payment of $830 was 42 percent higher than the average rent of $582. Only in Italy and Finland was buying found to be less expensive than renting, though not by much.

This week’s chart shows the competing costs in the 39 countries that were examined. National averages are a broad measure of costs, as prices can vary greatly within a single country, and laws governing purchases, visas and immigration play important roles when considering buying or renting internationally.

[ad_2]

Source link