Binance-backed Xend Finance launches DeFi platform for credit unions in Africa – TechCrunch

[ad_1]

Nigerian startup Xend Finance uses decentralized finance (DeFi) to address currency devaluation. DeFi aims to bridge the gap between decentralized blockchains and financial services. Aronu Ugochukwu and Abafor Chima founded the startup in 2019, and Ugochukwu is quite familiar with currency devaluation.

Currency devaluation is a common economic nightmare faced in most African countries and other developing countries worldwide. It has become imperative for organisations like credit unions to hedge their collective funds against their local currency’s devaluation.

“We’ve experienced three massive currency devaluations in the last three years in Nigeria, and this is similar to different economies in the world with unstable economies,” Ugochukwu said to TechCrunch. “My mother and I belong to different cooperatives where we save and make monthly contributions to help one another in the cooperative. Realizing that despite saving regularly, we were losing more value for our money. This gave birth to Xend Finance.”

Today, the company announced its mainnet launch, opening up the ability for credit unions to access DeFi for their members by using decentralized stablecoins such as DAI and BUSD.

Not only is Xend Finance trying to protect credit unions from fluctuation, but it is also changing how they operate. In these unions, groups of individuals contribute to informal savings for their different mutual benefits.

However, they are often limited by three factors. One is in its size — only a small knit of people in a particular locale can access the service. The second is lack of insurance, which means people don’t have the confidence to join saving cycles. The third has to do with how credit union members default in payments, affecting how much is paid down the line.

Image Credits: Xend Finance

Xend Finance is plugging these gaps using blockchain technology. The platform allows credit unions to have over 1,000 members who don’t stay in the same geographical location. It also employs smart contracts to lock each member’s contribution and enable flexible payouts when a payment cycle is due, which reduces default payment rates. The company also says it offers decentralized insurance to protect members against any form of asset loss that results from contract failures. However, this isn’t a traditional insurance contract from an insurance company.

Besides, the company says credit union members can earn interest in their savings by exchanging their crypto or fiat currency for stable cryptocurrencies and locking crypto assets on lending platforms. According to the company, there’s a possible 15% available annual percentage yield on the platform.

The company claims to be the world’s first decentralized finance (DeFi) credit union platform and the first DeFi company to launch out of Africa. Its technology is built on Binance Smart Chain (BSC), a blockchain for developing high-performance decentralized applications.

In 2019, the startup based in Enugu, Nigeria took part in the Google Launchpad Africa accelerator and the Binance Incubation Programme. It has since secured $2.2 million from Binance, Google Launchpad, NGC Ventures, Hashkey and AU21 Capital, among others.

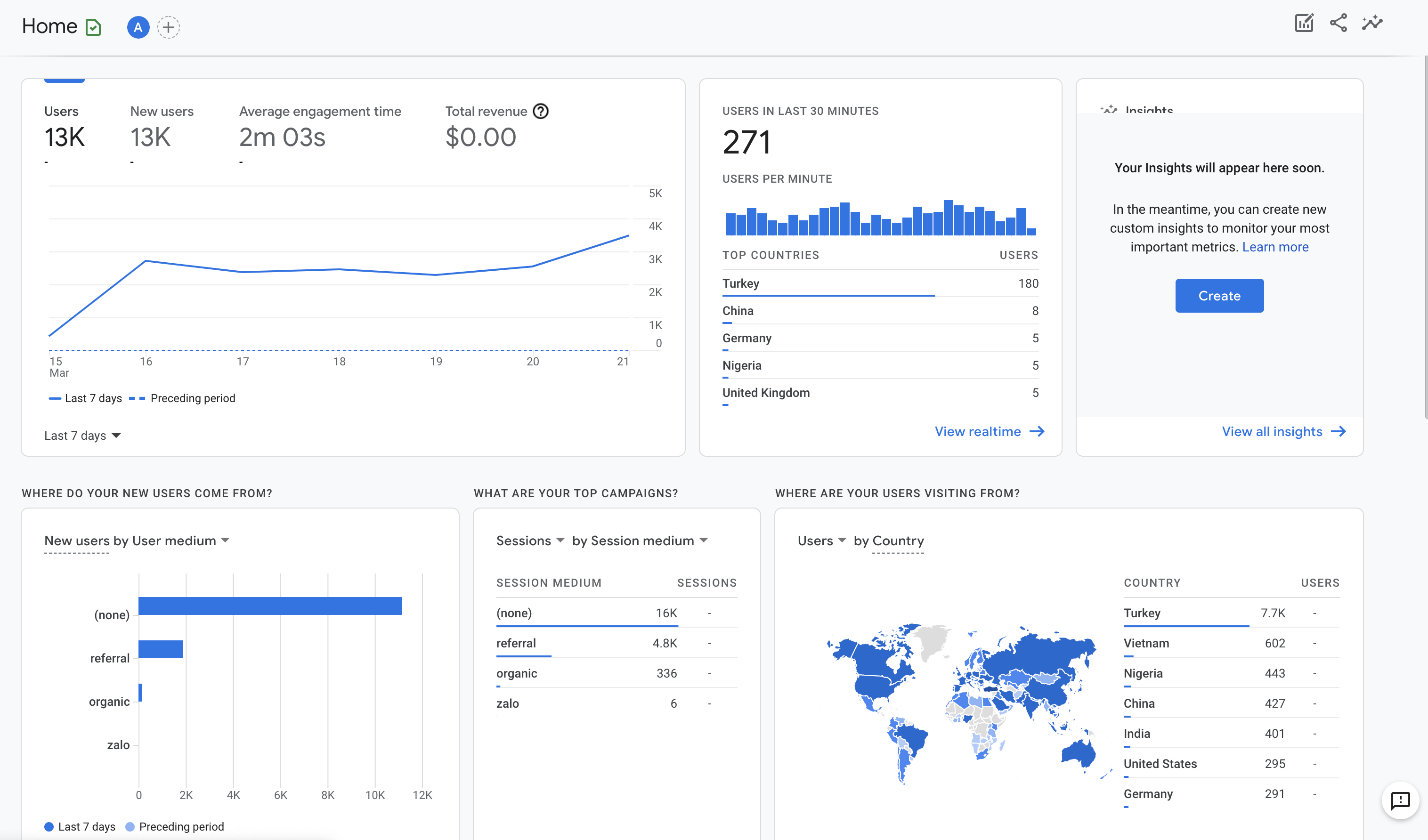

From December 2020 to January 2021, Xend Finance executed a testnet with over 1,500 participants in 75 countries. This helped them find product-market fit, and last week, the company did a beta launch of its mainnet where it received over $500,000 in deposits. They also signed a credit union partnership with a software service provider, TechFusion Africa and its 5,000 members.

Image Credits: Xend Finance

The company intends to onboard a lot of customers now and focus on revenue later, Ugochukwu says. And when it does, the play will be to charge a commission (not more than 5%) on the return on investment when members of cooperatives or regular individuals save or perform contributions on the platform.

Having run some tests and passed several iterations, Xend Finance is fully going public today, and Changpeng “CZ” Zhao, CEO of Binance, expects the platform to show what can be built on BSC.

“Africa is one of the most important continents, representing the future and emergence of DeFi and blockchain capabilities,” said Zhao. “We are very excited about the mainnet launch of Xend Finance, with a team we backed early on that has a strong foothold in Africa and have been strong advocates for what Binance Smart Chain can accomplish. With their platform, they can bring stable currency and DeFi investment opportunities to those who normally wouldn’t have them.”

Along with the mainnet launch, Xend Finance will introduce the $XEND token through a Token Generation Event (TGE) on Balancer. The company says the token will reward users for performing different operations in “the protocol, as well as allows a decentralized governance of the Xend Finance ecosystem.”

For Ugochukwu, Xend Finance presents people with the opportunity to channel their savings into stablecoins without worry that their money will devalue overnight and earn higher interest rates through DeFi. “We are very excited that blockchain will have a positive impact on the people of Africa,” he said.

[ad_2]

Source link