BlackCart raises $8.8M Series A for its try-before-you-buy platform for online merchants – TechCrunch

[ad_1]

A startup called BlackCart is tackling one of the key challenges with online shopping: an inability to try on or test out the merchandise before making a purchase. That company, which has now closed on $8.8 million in Series A funding, has built a try-before-you-buy platform that integrates with e-commerce storefronts, allowing customers to ship items to their home for free and only pay if they choose to keep the item after a “try on” period has lapsed.

The new round of financing was led by Origin Ventures and Hyde Park Ventures Partners, and saw participation from Struck Capital, Citi Ventures, 500 Startups and several other angel investors, including Christian Sullivan of Republic Labs, Dean Bakes of M3 Ventures, Greg Rudin of Menlo Ventures, Jordan Nathan of Caraway Cookware and First National Bank CFO Nick Pirollo, among others.

The Toronto-based company last year had raised a $2 million seed.

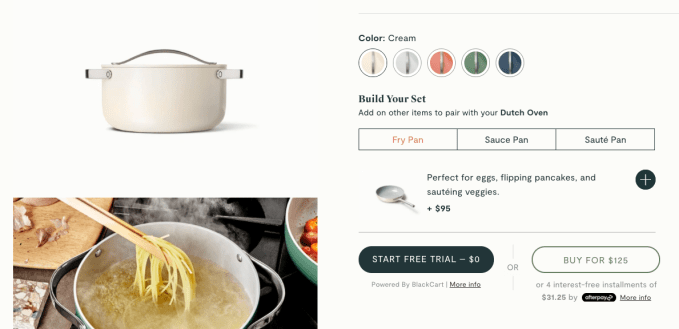

Image Credits: BlackCart

BlackCart founder Donny Ouyang had previously founded online tutoring marketplace Rayku before joining a seed-stage VC fund, Caravan Ventures. But he was inspired to return to entrepreneurship, he says, after experiencing a personal problem with trying to order shoes online.

Realizing the opportunity for a “try before you buy” type of service, Ouyang first built BlackCart in 2017 as a business-to-consumer (B2C) platform that worked by way of a Chrome extension with some 50 different online merchants, largely in apparel.

This MVP of sorts proved there was consumer demand for something like this in online shopping.

Ouyang credits the earlier version of BlackCart with helping the team to understand what sort of products work best for this service.

“I think, in general, for try-before-you-buy, anything that’s moderate to higher price points, lower frequency of purchase, where the customer makes a considered purchase decision — those perform really well,” he says.

Two years later, Ouyang took BlackCart to 500 Startups in San Francisco, where he then pivoted the business to the B2B offering it is today.

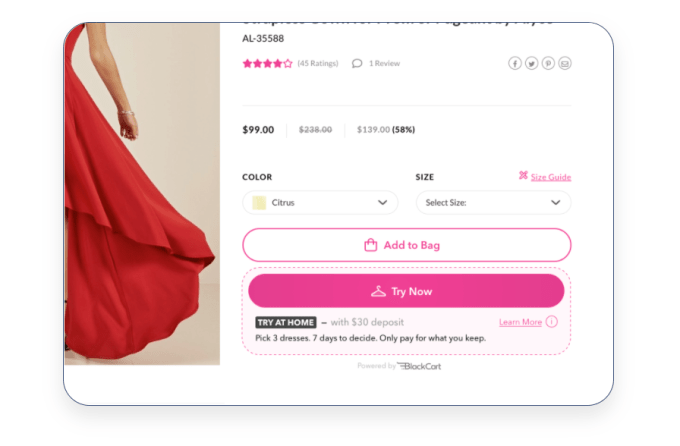

Image Credits: BlackCart

The startup now provides a try-before-you-buy platform that integrates with online storefronts, including those from Shopify, Magento, WooCommerce, Big Commerce, SalesForce Commerce Cloud, WordPress and even custom storefronts. The system is designed to be turnkey for online retailers and takes around 48 hours to set up on Shopify and around a week on Magento, for example.

BlackCart has also developed its own proprietary technology around fraud detection, payments, returns and the overall user experience, which includes a button for retailers’ websites.

Because the online shoppers aren’t paying upfront for the merchandise they’re being shipped, BlackCart has to rely on an expanded array of behavioral signals and data in order to make a determination about whether the customer represents a fraud risk. As one example, if the customer had read a lot of helpdesk articles about fraud before placing their order, that could be flagged as a negative signal.

BlackCart also verifies the user’s phone number at checkout and matches it to telco and government data sets to see if their historical addresses match their shipping and billing addresses.

Image Credits: BlackCart

After the customer receives the item, they are able to keep it for a period of time (as designated by the retailer) before being charged. BlackCart covers any fraud as part of its value proposition to retailers.

BlackCart makes money by way of a rev share model, where it charges retailers a percentage of the sales where the customers have kept the products. This amount can vary based on a number of factors, like the fraud multiplier, average order value, the type of product and others. At the low end, it’s around 4% and around 10% on the high end, Ouyang says.

The company has also expanded beyond home try-on to include try-before-you-buy for electronics, jewelry, home goods and more. It can even ship out makeup samples for home try-on, as another option.

Once integrated on a website, BlackCart claims its merchants typically see conversion increases of 24%, average order values climb by 51% and bottom-line sales growth of 27%.

To date, the platform has been adopted by more than 50 medium-to-large retailers, as well as e-commerce startups, like luxury sneaker brand Koio, clothing startup Dia&Co, online mattress startup Helix Sleep and cookware startup Caraway, among others. It’s also under NDA now with a top-50 retailer it can’t yet name publicly, and has contracts signed with 13 others that are waiting to be onboarded.

Soon, BlackCart aims to offer a self-serve onboarding process, Ouyang notes.

“This would be later, end of Q2 or early Q3,” he says. “But I think for us, it will still be probably 80% self-serve, and then larger enterprises will want to be handheld.”

With the additional funding, BlackCart aims to shift to paying the merchant immediately for the items at checkout, then reconciling afterwards in order to be more efficient. This has been one of merchants’ biggest feature requests, as well.

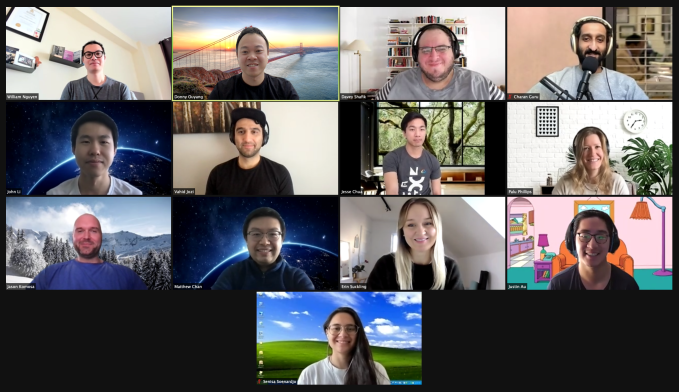

Image Credits: BlackCart; team photo

The funding will also allow BlackCart to expand its remotely distributed 10-person team to around 50 by year-end, including engineers, product specialists, customer support staff and sales.

More broadly, it aims to quickly capitalize on the growth in the e-commerce market, driven by the COVID-19 pandemic.

“[We want to] take advantage of the favorable macroeconomic situation to scale as quickly as possible,” Ouyang explains. “We’re hoping to get to around $250 million in transactions through our platform by the end of 2021. And this would be driven by both engineering and sales hires, and just pushing it up,” he says.

Longer-term, Ouyang envisions adding more consumer-facing features to BlackCart’s platform, like on-demand returns where a courier comes to the house to pick up your return, for example.

“Our firm is excited to partner with BlackCart as it makes try-before-you-buy the standard in online shopping,” said Prashant Shukla of Origin Ventures, who now sits on BlackCart’s board, as result of the new financing. “Its underwriting technology provides merchants with peace of mind, and its best-in-class consumer experience delivers significant sales and conversion lifts. Digital Native generations expect to be able to shop online exactly as they would in a retail store, and BlackCart is the only company providing this experience,” he adds.

[ad_2]

Source link