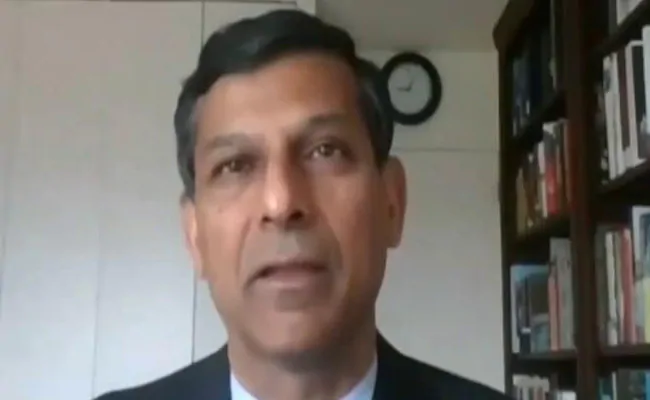

Drastic Changes In Monetary Policy Framework Can Upset Bond Market: Raghuram Rajan

[ad_1]

The RBI has the mandate to maintain retail inflation at 4 per cent, with a margin of 2 per cent

New Delhi:

As the economy slowly comes out of the pandemic blues, former RBI Governor Raghuram Rajan on Sunday cautioned that “drastic changes” in India’s monetary policy framework can upset the bond market as the current system has helped in containing inflation and promoting growth.

Mr Rajan, also a noted economist, opined that the government’s ambitious target to make India a USD 5-trillion economy by 2024-25 was “more aspirational, rather than a carefully computed one even before the pandemic”.

“I believe the (monetary policy) framework has helped bring inflation down, while giving the RBI some flexibility to support the economy. It is hard to think of what would have happened if we had to run such large fiscal deficits without such a framework in place,” Mr Rajan told PTI in an interview.

His remarks were in response to a query on whether he was in favour of reviewing the 2-6 per cent target band for inflation under the monetary policy framework.

The Reserve Bank of India (RBI) has the mandate to maintain retail inflation at 4 per cent with a margin of 2 per cent on either side. The central bank’s six-member monetary policy committee (MPC) headed by RBI Governor decides on policy rates keeping this target in mind.

The current medium-term inflation target, which was notified in August 2016, ends on March 31. The inflation target for the next five years starting April is likely to be notified this month.

Against this backdrop, Mr Rajan said, “We risk upsetting bond markets if we make drastic changes in the framework”.

“I think the framework has been beneficial in bringing down inflation, I don’t think it has been costly in slowing growth, and this is probably the wrong time to make drastic changes,” he pointed out.

With the government embarking on substantial borrowing plans to boost the coronavirus pandemic-hit economy, there are concerns among certain quarters about the overall financial health, and bond yields have also been on an upward trajectory. The latter trend indicates that government borrowings could become more costly.

About reform measures, Mr Rajan said that while the 2021-22 budget has placed a lot of weight on privatisation, the history of the government delivering on this is checkered, and he wondered how it will be different this time.

He pointed out that in the latest Budget, laudably, there is more transparency about the true extent of spending, as well as a degree of conservatism about budget receipts that has not been seen in recent budgets.

[ad_2]

Source link