Here’s How Rising Inflation Is Affecting Higher Ed

[ad_1]

Like every other industry right now, higher education is grappling with the effects of raging inflation, tempering much of the other news, largely good, about higher ed’s finances.

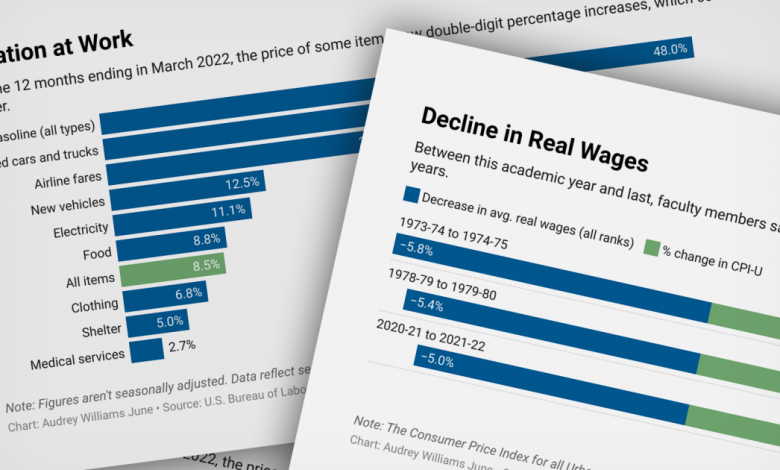

While college endowments saw stellar returns in the 2021 fiscal year, investment managers believed that navigating rising inflation would be a long-term challenge, according to a recent endowment study by the National Association of College and University Business Officers. And an early look at state spending on higher education in the 2022 fiscal year showed that it was up 8.5 percent from the year before. But that increase has essentially been canceled out by the jump in inflation for the 12 months ending in March.

With inflation at a four-decade high, the findings in new provisional data about faculty pay took on a different level of urgency. According to the American Association of University Professors’ most recent faculty compensation survey, real (or inflation-adjusted) average salaries for faculty members fell 5 percent between the 2020-21 academic year and the current one.

That’s the greatest decrease in real wage growth since the 1979-80 academic year, when inflation, as measured by the Consumer Price Index for All Urban Consumers, or CPI-U, rose more than 12 percent, the association said.

Meanwhile, a new report from Moody’s Investors Service warned that tuition-revenue growth could be reduced at many institutions.

The factors in play? A strong labor market and high inflation, analysts at the bond-ratings agency wrote.

For more data on inflation’s impact on higher education and the people employed in the sector, see below:

The number of states where the year-over-year change in support for public colleges in the 2022 fiscal year either declined or increased by less than the rate of inflation over the last year.

[ad_2]

Source link