Here’s Where Beach House Rentals Earn the Most Revenue

[ad_1]

As hopeful home buyers flounder in a frustrating market, many are opting to hang on to rental properties in pricey areas and make a second home their first home purchase. As the thinking goes: Buying in another, less expensive market is the only path to homeownership, and this way they can keep some rental income in the mix.

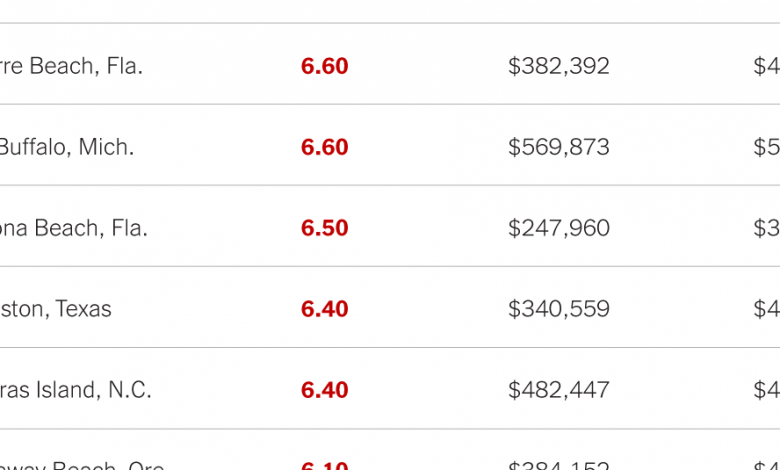

With summer around the corner, we’ve turned to Vacasa, a property management company, for data on the profitability of rental beach house properties in various U.S. locales. (The company also tracks data on lake houses and winter vacation homes.)

The report ranks beach towns by capitalization rate (or “cap rate”), a metric used to determine the profitability of rental properties. Cap rate is found by comparing a home’s sale price with what remains of the annual rental revenue after expenses are met. For example, if a home sold for $300,000 and took in $3,000 of annual rent revenue after expenses, the cap rate would be 1 percent. The higher the cap rate, the more profitable the property.

Home sales and vacation rental data from the past year were examined using actual available homeowner revenue. Vacasa’s exclusive data was used in areas where the company managed at least 50 units. Average taxes, HOA fees, utilities, insurance and management fees in each area were subtracted from average annual rental income to help find the cap rate.

Of the top 10 most profitable areas, seven were found to be in the South. Gulf Shores, Ala., was at the top, followed by three cities in Florida, two in North Carolina and one in Texas.

This week’s chart shows the 10 most profitable areas for beach rentals based on Vacasa’s analysis, as well as the median home price and average gross (before expenses) rental income in each.

[ad_2]

Source link