How Are People Spending Their Home-Equity Loans?

As property values skyrocketed through 2021, homeowners in the United States found themselves with a lot more home equity — and historically low interest rates gave them extra incentive to turn the equity into cash.

To get a sense of how homeowners planned to spend that money — and how those plans differed among major metropolitan areas around the country — the online lending platform LendingTree studied data from nearly 2.3 million homeowners who visited the site in 2021 and were offered home equity loans or home equity lines of credit. As part of the application process, those borrowers selected one of five reasons as to why they sought the loan: home improvement, debt consolidation, investment, retirement income or another purpose. Their answers form the basis of this week’s chart.

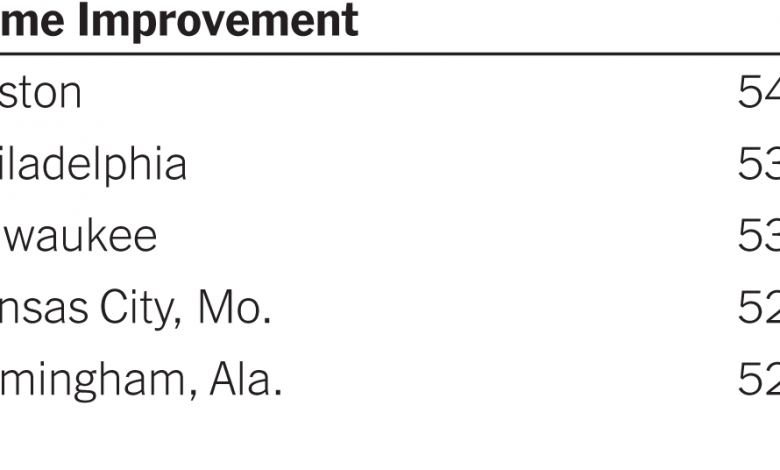

Perhaps it’s no surprise that home improvement was the most popular motivation for loan applicants in every metro area featured in the study, and about 49 percent overall. Last week, the Joint Center for Housing Studies of Harvard University reported that annual increases in spending on home remodeling rose from 4.7 percent in the first quarter of 2021 to 9.5 percent in the fourth quarter, and double-digit increases are projected into 2022. According to LendingTree, the Boston and Philadelphia metro areas, both rife with older housing stock, had the highest shares of loan applicants planning on home improvements.

The second most popular plan for home equity funds was debt consolidation. Las Vegas led in the category, with 32 percent of applicants checking that box. Las Vegas also had the largest share of homeowners tapping home equity for retirement income — though it was only 2.5 percent of applicants, making it clear that generating retirement income was the least popular motivation among borrowers. (About 17 percent of all applicants stated unknown plans or preferred not to reveal them.)

Finally, nearly one in 10 applicants across the country indicated that investment was their main goal for taking out a home-equity loan. The cities with the largest shares of investment-minded borrowers were San Jose, Calif., Miami and Austin, Texas.

This week’s chart shows the five metro areas in which applicants most planned for each use.

Source link