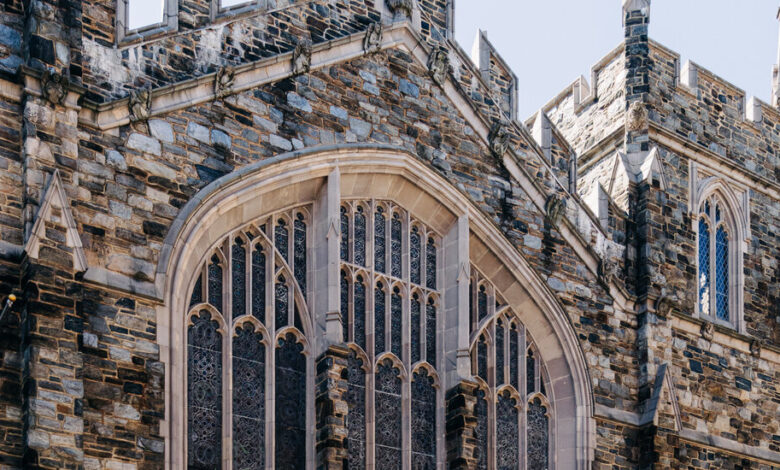

How the Renovation of a House Rocked a Famous Church

[ad_1]

A year later, in spring 2018, when Ms. Porter and Mr. Porter, 46, who works in tech security, were getting ready to remodel the house, they did not know that the Internal Revenue Service had recently levied a nearly $75,000 tax lien against Mr. Yeiser and that he and his wife had filed for bankruptcy in the past. They would first learn about the tax troubles when Mr. Yeiser explained to them why he couldn’t pay the subcontractors, according to the Porters’ countersuit.

All the couple knew was that Mr. Yeiser had agreed to renovate their kitchen, bathrooms and add an addition to the garden level apartment, with a deck above it that would open onto the kitchen, a $539,000 job, according to the renovation agreement between Siva Real Estate and the Porters.

For the first few months, work moved along without incident — walls came down; electrical, plumbing and HVAC systems went in, according to the countersuit and a video The Times reviewed of a meeting between Mr. Yeiser and Ms. Porter. But in December 2018, the work came to a halt, “unexpectedly and inexplicably,” according to the countersuit.

The countersuit details mounting anxiety and confusion: When the Porters asked questions — in emails and in person — Mr. Yeiser told them that his bank account was frozen because of unpaid taxes, and some of their money had been used to pay his taxes; but the money would be released soon, he promised. As the weeks went by and the winter set in with no work getting done, the Porters learned that the subcontractors had not been paid in months; inspections had not been completed and Mr. Yeiser was not a licensed contractor. (Mr. Yeiser’s license expired in 2013, according to the city’s Department of Consumer and Worker Protection.)

Tally it up, and $192,758 was unaccounted for, the countersuit alleges.

In March 2019, Mr. Yeiser quit over email.

[ad_2]

Source link