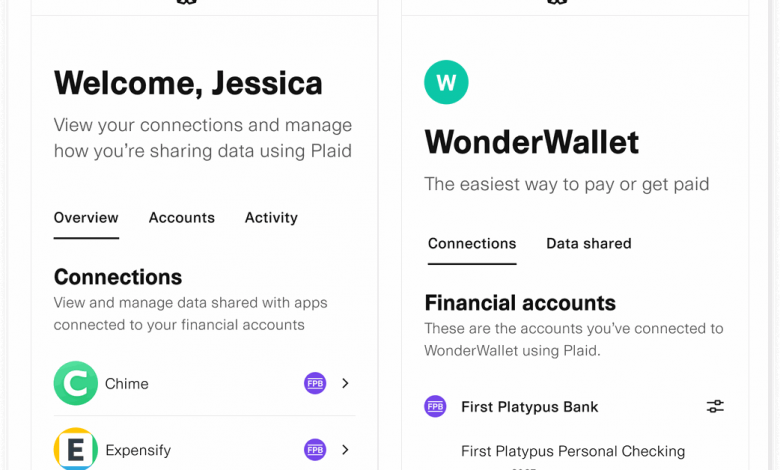

Plaid’s new privacy controls let you manage your financial data from a single hub

[ad_1]

Plaid, a go-between for financial apps like Robinhood, Venmo, and Betterment and bank accounts, has created a privacy hub where you can manage all of your financial connections. The hub is a requirement of a lawsuit Plaid settled about its handling of user data.

The hub, called Plaid Portal, shows users exactly which apps they’re connected to by Plaid. It can be found by accessing my.plaid.com, where the service will prompt users to set up an account. Then, it’s possible to browse connections and disconnect unused apps from bank accounts. The portal details the kinds of data users sharing through Plaid, as well as which bank accounts are connected. It’s also possible to wipe all of a user’s linked data through the portal.

Plaid, which is used by more than 5,500 apps to connect to bank accounts, has been accused of taking too much financial data from users and using that information to access and sell their transaction history. A class-action suit alleged that Plaid collected users’ bank account login information through web pages that mimicked “the look and feel of the user’s own bank account login screen.” The company settled the suit for $58 million without admitting wrongdoing, and claimed it was adequately transparent with the user.

As part of the settlement, Plaid is required to delete some of its stored data, minimize the data it collects going forward, as well as “improve and maintain” the changes it has already made to Plaid Link, the tool Plaid uses to connect users’ bank accounts to apps. It was also required to create a privacy dashboard, which we now know as the Plaid Portal.

If you’re a US resident and connected your bank account through Plaid from January 1st, 2013 and November 19th, 2021, remember to file a claim through the class-action settlement’s site by April 28th, 2022.

[ad_2]

Source link