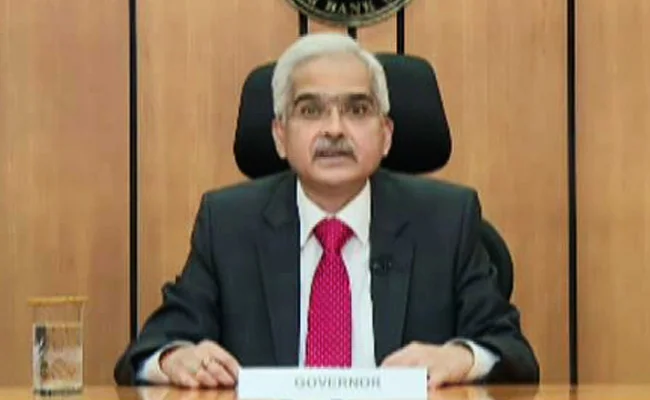

RBI Governor Shaktikanta Das Announces Term Liquidity Facility Of Rs 50,000 Crore

[ad_1]

Banks can lend more to medical services sector till March 31, 2022, RBI Governor said

The Reserve Bank of India will provide a term-liquidity facility of Rs 50,000 crore to ease access of funds for emergency medical services, the Governor Shaktikanta Das said at a time when India has emerged as the coronavirus hotspot and surging cases have overwhelmed the healthcare system.

Under the liquidity scheme, banks can support entities including vaccine manufacturers, medical facilities, hospitals and patients. The funds will be provided for a tenure of up to 3 years and this lending will get priority sector classification till repayment or maturity.

Banks can create a special loan book and park liquidity equal to their Covid loans at 40 basis points above the reverse repo rate.

Shaktikanta Das expressed faith in India’s ability to come out of Covid-19 crisis and added that RBI continues to monitor the situation closely. India has already crossed the 2-crore mark in total Covid infections caseload, which is the second highest globally — just behind the United States and ahead of Brazil. India is fighting a ferocious rise in coronavirus cases and we have to marshall all our resources with renewed vigour, the Governor emphasized.

Among other measures, the RBI announced targeted long-term repo operation for small finance banks of up to Rs 10,000 crore. The funds can be used for lending of up to Rs 10 lakh per borrower.

[ad_2]

Source link