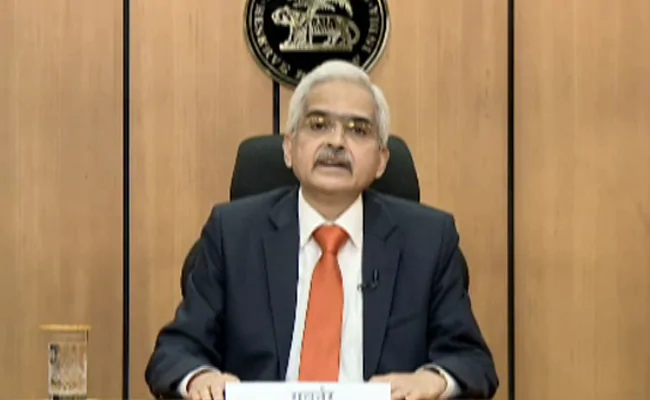

Reserve Bank Of India (RBI) Governor Shaktikanta Das Monetary Policy Statement, Repo Rate Unchanged, Inflation Rate, GDP Growth

[ad_1]

MPC Meet Highlights: Shaktikanta Das kept repo rates unchanged at four per cent

RBI Monetary Policy 2021: Reserve Bank of India Governor Shaktikanta Das-led Monetary Policy Committee (MPC) announced its policy decision today, at the end of a scheduled review that began on Wednesday. The Monetary Policy Committee, in its first post-budget meet, voted unanimously to keep the policy rate unchanged at four per cent. The RBI expects the gross domestic product (GDP) growth to be at 10.5 per cent in the next fiscal year, starting April 2021. RBI Governor Shaktikanta Das said that the economy’s growth outlook had improved and that inflation was expected to remain within the central bank’s targeted range over the next few quarters. (Also Read: At 10.5%, RBI Pegs Economic Growth Lower Than IMF And Eco Survey )

In a significant structural reform, Mr Das announced that retail investors will get direct access to the government securities market – both primary and secondary – directly through the Reserve Bank of India (Retail Direct). To support the economy amid the COVID-19 crisis, the Reserve Bank slashed its key lending rate i.e. repo rate by 115 basis points since March 2020, following a 135 basis points reduction since the beginning of 2019.

Here are the key highlights from today’s RBI Governor Shaktikanta Das-led Monetary Policy Committee meeting:

RBI Governor Shaktikanta Das said that the digital currency is a work in the progress at the central bank. In this regard, the government is looking to launch a state owned digital currency.

Shaktikanta Das said that as the GDP grows and the economy grows, the total volume of savings and deposits will expand. He added that the Retail Direct plan will not harm the banks. The scheme has placed India among few selected countries that have similar facilities.

RBI Governor said that retail direct is a major structural reform. ‘It has been our endeavour to make G-Sec market accessible to retail investors’, he added. The central bank has allowed retail investors to open gilt accounts with the Reserve Bank of India in order to deepen the financial markets.

RBI Governor Shaktikanta Das will address a press conference at 12 noon today, starting any minute now. The RBI Governor is expected to address queries related to the bi-monthly MPC decisions taken today and other key decisions announced by the central bank.

To develop International Financial Service Centres (IFSCs), the Reserve Bank of India today proposed to permit residents to make remittances to IFSC for investment in securities issued by non-resident securities in IFSC.

SLR Holdings in Held to Maturity (HTM) category

On September 1, 2020, the central bank increased the limits under Held to Maturity category from 19.5 per cent to 22 per cent of net demand and time liabilities (NDTL) in respect of statutory liquidity ratio (SLR) eligible securities acquired on or after September 1, 2020, up to March 31, 2021. The HTM limits will be restored from 22 per cent to 19.5 per cent in a phased manner starting from the quarter ending June 30, 2023, according to RBI.

Setting up of 24×7 Helpline for Digital Payment Services

The RBI addressed that with enhanced penetration of digital payments, major payment system operators will be required to facilitate setting-up of a centralised industrywide 24×7 helpline for addressing customer queries in respect of various digital payment products and give information on available grievance redress mechanisms.

Credit to MSME Entrepreneurs

The scheduled commerical banks will be allowed to deduct the credit disbursed to new MSME borrowed from their NDTL for the calculation of CRR. New MSME borrowers will be those who have not accessed funds from banks till January 2021.

The Cash Reserve Ratio (CRR) of all banks was reduced by 100 basis points to 3.0 per cent for a period of one year ending on March 26, 2021.

Shaktikanta Das announced that MSF has been extended by the Reserve Bank of India by another six months, up to Septemeber 30, 2021. This step will make it easy for lenders to access funds.

RBI Governor Shaktikanta Das said that the projected increase in capital expenditure augurs well for capacity creation and crowding-in private investment, improving growth prospects. The central bank projected GDP growth at 10 per cent for financial year 2021-22

The central bank proposed to provide funds from banks under the TLTRO on tap scheme to non-banking financial company (NBFC) to specified sectors.

The Monetary Policy Committee expects CPI inflation to be 5.2 per cent in fourth quarter of this fiscal year. In the coming fiscal year, it is expected to be in the range of 5.2 per cent to 5 per cent in the first half. For third quarter of next fiscal year, that inflation is pegged at 4.3 per cent with risk broadly balanced.

Direct access to retail investors in G-Sec market

Mr Das announced that the retail investors can now access primary, secondary government bond market. The central bank has allowed retail investors to open gilt accounts with the Reserve Bank of India in order to deepen the financial markets. The RBI Governor said that it is a major structural reform placing India among select few countries which have similar facilities

RBI Governor Shaktikanta Das announced that the central bank remains committed to ensuring there is ample liquidity in the financial system. He said that the overall monetary policy stance and the liquidity for the banking system is accommodative.

Shaktikanta Das keeps reverse repo rate unchanged

The Monetary Policy Committee led by the RBI Governor kept the reverse repo rate – or its borrowing rate, unchanged at 3.35 per cent.

RBI Governor Shaktikanta Das said that the MPC expects the gross domestic product (GDP) growth to be at 10.5 per cent in 2021-22. It also expects GDP to be in the range of 26.2 per cent to 8.3 per cent in first half and six per cent in the third quarter of the coming fiscal year.

The Monetary Policy Committee led by RBI Governor announced that it has decided to keep rates unchanged in its first bi-monthly meeting of 2021. The vote was unanimous in favour of maintaining the status quo.

RBI Governor Shaktikanta Das began addressing the monetary policy statement at 10:00 am on Friday, February 5. A post policy press conference will be telecast at 12:00 noon today

[ad_2]

Source link