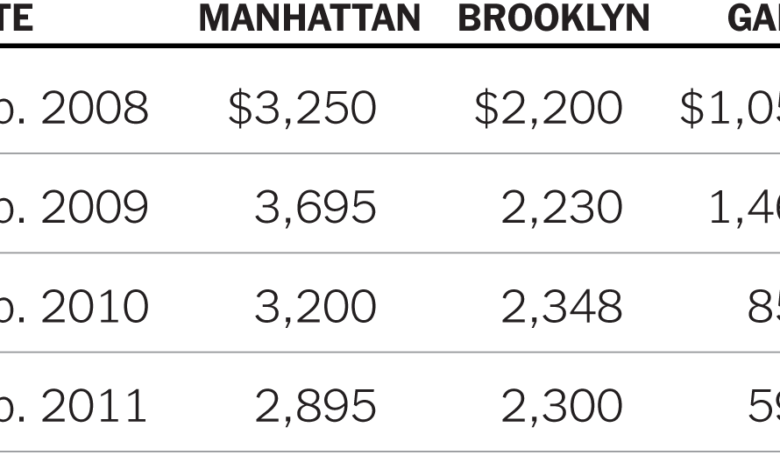

The Brooklyn-Manhattan Rent Gap Is Shrinking Fast

[ad_1]

Twenty or 30 years ago, you went to Brooklyn because you couldn’t afford Manhattan rents. By the early 2000s, the borough began catching up with its more expensive neighbor. A new generation of residents was moving in, a sports arena was in the works and lots of new development was rising — along with rents.

“After the financial crisis, Brooklyn transformed from a cheaper alternative to Manhattan to something new,” said Jonathan Miller, of Miller Samuel, the appraisal company. “The Brooklyn brand became global.”

Mr. Miller provided data for this week’s chart, which shows the narrowing gap in median rent on new leases in the two boroughs. In February 2009, the median rent in Brooklyn was $1,465 cheaper than in Manhattan. Four years later, the gap was just $600. Brooklyn was booming, with many renters pushed out of Brooklyn Heights, Cobble Hill, Carroll Gardens and Park Slope, and into neighborhoods like Bushwick, Prospect Lefferts Gardens and Sunset Park.

By February 2014, the gap separating the boroughs’ median rents had dwindled to $210. The following year, driven by new development, Manhattan rents jumped, stretching it back to $777. “In terms of new development, Manhattan was condo and the other boroughs were rental,” Mr. Miller said. “But the condos were heavily skewed toward investor units, so you had a lot of $10,000 to $20,000 rental units being added to the market that skewed Manhattan rents higher.”

After 2015, rents in both boroughs slowly grew, and the gap between them leveled off, settling into an average of $534 by 2019. Then the pandemic changed everything. Record vacancies in Manhattan reduced asking prices, and the gap shrank to $171 by November 2020, the smallest since Mr. Miller began tracking it 2008. It has grown a bit in the months since, but the coronavirus has dramatically altered the playing field.

“My crystal ball is held together with gray duct tape,” joked Mr. Miller. “Since the fall, both boroughs have been seeing unusually heavy lease-signing activity, which is a baby step in prices beginning to stabilize.”

Still, the future for New York’s rental market, and for working at home, remains hard to predict. “When Covid is resolved,” he said, “hopefully with a favorable outcome, there’s still Zoom.”

[ad_2]

Source link