The College That Drowned Itself in Red Ink

[ad_1]

It’s the institutional scholarships totaling $18,000, more than half of the cost of attendance, that most puzzle her now. How could a university that couldn’t pay its bills offer her such generous aid?

Schramm was one of some 175 students left stranded when the West Virginia university voted in December to close its doors after more than 60 years in operation. Leading up to the decision, even basic transactions had become a struggle: Students couldn’t get copies of their transcripts, and some employees hadn’t been paid for months. Spurred by those complaints, the West Virginia Higher Education Policy Commission announced that it would convene on December 10 to determine OVU’s future. But three days before that meeting would take place, OVU’s board elected to shut down the university rather than have the State of West Virginia do it for them. And so, after decades of increasingly desperate attempts to stay alive, Ohio Valley University was finally dead.

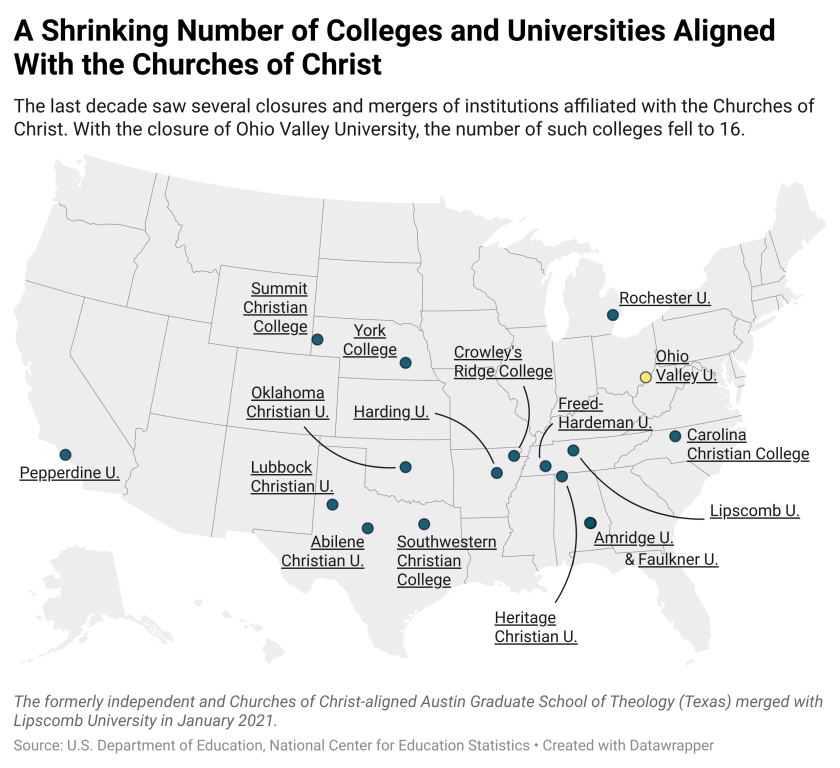

Like so many institutions that have closed or sought to merge with another university in recent years, Ohio Valley was doomed by shrinking enrollments and unsustainable debts. But few colleges — if any — have ever gone to the lengths that OVU did to try to save themselves from extinction. In time, though, this dedication to OVU’s survival would come to justify an untenable reliance on increasingly complex, unconventional, and risky financial vehicles — vehicles that would eventually leave the institution more and more vulnerable. All the while, Ohio Valley, one of the few remaining academic bastions of the Churches of Christ, left its students in the dark about its financial state. Indeed, OVU’s torturous struggle to stay alive stands in contrast to the mathematical models that very likely would have forecast its closure years ago — a stark reminder that it’s not spreadsheets but the human beings serving on governing boards and in regulatory offices who ultimately decide when to kill colleges and universities.

The perilous state of the institution’s finances was clear to its leaders and investors as early as 2019, when OVU pleaded with its creditors to sell off its debt at a steep discount to a set of benefactors aligned with the university. “If we do not receive a positive response from substantially all of the bondholders,” an OVU representative warned in a letter dated June 12 of that year, “it will prevent OVU from continuing as an institution and likely force bankruptcy or receivership, resulting in substantial receivership costs and a ‘fire sale’ leaving little for the bondholders.”

Ultimately, those bondholders did not accept the offer, and in September 2019, the university began defaulting on its debt. Nearly eight months later, Schramm would sign to run track for the Fighting Scots, completely unaware of OVU’s dismal financial health.

During a contentious back-and-forth with students at the campus chapel on December 7, when the college announced its doors would be permanently shut by Christmas, Schramm said some undergrads accused the university’s leadership of obfuscation. Administrators said an accreditor’s letter describing OVU’s probationary status was clearly listed on the university’s landing page, in the bottom right corner. A click, a click, some down-scrolling, and then one more click, and students would have been able to find references to OVU’s poor finances summarized in a report prepared by the Higher Learning Commission. One just needed to know where to look. And what they were looking for. And what they were looking at.

Asked to comment for this article, Michael Ross, who became president of OVU in January 2019, emailed a news release. “OVU strives to be an institution that conducts business with integrity while being good stewards of our resources,” the statement read. “Our current situation precludes us from fulfilling those intentions in a satisfactory way.” Additional requests seeking interviews or comments from Ross or other current leaders did not receive responses.

Was Ohio Valley wrong to hold out for a miracle? Brandon Brammer, another track athlete who graduated in December with a bachelor’s degree in biblical studies, sees OVU’s choice to hold out against surrender for as long as possible as proof that he was blessed to be part of a community willing to sacrifice so much for its students. “I play back all those scenarios where I could have gone somewhere else,” Brammer said. “But this was my college. No matter what was going on. And no matter how sour things got.”

Schramm, though, was less charitable. Sure, OVU’s board and leadership had worked tirelessly to save the university. And yet no one could find the time to secure the accreditor’s approval for a teach-out plan before December 7, which would have given OVU students at least one option to finish out their studies for the year?

“I feel like they put their egos ahead of the students,” Schramm said.

Moore acknowledged that the debts previous boards had incurred had grown burdensome, but he then defended those debts as necessary, even laudable. “Had they not taken on the debt we needed, we wouldn’t be in this” chapel, Moore said during the November speech. “We wouldn’t have two new dorms from a few years ago. A new science center. … We wouldn’t be a four-year liberal-arts institution. We probably would not be a four-year college.”

As damaging as the debt had become, the university had more-fundamental problems. In his June 2019 petition to bondholders, Mike E. O’Neal, senior financial adviser to Ohio Valley, conceded that the institution’s difficulties weren’t a result of a single miserable fiscal year or poor-performing strategy. The university, he wrote, “for the past 15-20 years has been fighting an uphill financial battle.”

Over the course of 21 years, Ohio Valley ran an operating deficit in all but five, according to disclosures to the U.S. Department of Education. In 2004, the IRS issued a federal tax lien against Ohio Valley. And come 2005-6, the Education Department mandated that OVU secure a $340,000 letter of credit if it wanted to continue to participate in federal student-aid programs. The government would eventually require the university to secure a new letter of credit for each fiscal year from 2009 to 2018.

Frequently starved for cash, OVU became dependent on debt to finance basic operations. Typically, institutions in similar positions turn to banks and financial institutions. OVU did not. Instead, the university pursued an unusual strategy: It relied on individuals for credit, including those with close ties to the institution. By May 2006, the accumulated debt owed to individuals had become one of OVU’s largest liabilities, totaling $6 million, with interest rates as high as 13.25 percent. And because individual creditors could demand redemption of their so-called patron loans at any time, financial panics were routine. The activity “has created severe strains on the financial health of the institution,” the university told investors in 2007.

To liberate itself from these financial-life-preservers-turned-anchors, Ohio Valley entered the bond market, where it found investors willing to lend the university more than $17 million for its unrated debt. OVU in turn used that money to refund bonds previously issued and refinance the patron loans.

Some of OVU’s leaders saw an opportunity for the institution to get a fresh start. Around the time the bonds were issued, J. Kevin Ramsey, the board’s longtime vice chair for finance, until 2012-13, said he had told his fellow board members they had a critical choice to make. By using proceeds from the bond issuance to pay down patron loans, OVU had been provided a lifeline. It was up to board members, he said, to limit the institution’s use of the patron loans as much as possible. If they couldn’t, Ohio Valley would find itself once again fighting a losing battle for survival.

“‘Don’t you dare borrow any money from individuals,’” Ramsey, who once also served as chairman of the board, recalled warning trustees. “‘You must live within your debts. You must address all of your employees, faculty, and whatnot so that you have a balanced budget. I do not want to see any more private debt.’”

Gail Hopkins, OVU’s board chair from 2004 until 2019, said he didn’t want to see any more private debt either. Nor did anyone else on the board, he recalled. But as fewer and fewer tuition dollars came in, Ohio Valley returned to the tool that had gotten it into trouble in the first place: patron loans, many lent by board members and administrators.

Between the 2009 and 2019 fiscal years, OVU borrowed at least $6.5 million from current and former board members and officers, as well as from family members and related companies. Even Ramsey, who preached against the practice, advanced a small loan of $8,500 in 2010-11. The Chronicle identified at least 90 loans from OVU insiders, with interest rates as high as 8 percent, after reviewing more than a decade of filings prepared for the Internal Revenue Service. Of all of the loans extended by this group, the balance owed on at least 65 agreements at some point during the last decade exceeded each loan’s principal. For instance, OVU owed an additional $108,000 in interest on a $400,000 loan extended by a former trustee during the 2010 fiscal year. The university still owes almost $200,000 to individuals.

It’s unclear from the public record what has become of these patron loans. In some cases, the university repaid them in full with interest, said Jeff Dimick, who served as OVU’s executive vice president from 2012 to 2018 — and once extended a loan to the institution himself. In others, individuals forgave the debt, as he did (he said he deducted the principal of the forgiven loans against his taxes). Other patrons simply allowed their debt to be rolled over onto a new fiscal year’s balance sheet.

And, perhaps even more unusually, OVU entered into these borrowing arrangements with insiders without the approval of its governing board or a committee delegated with that authority, according to federal tax forms filed by the university between the 2009 and 2013 fiscal years.

Ramsey, the former chair and vice chair of finance, said such moves ultimately persuaded him to leave the board. But his departure failed to resolve his own financial entanglements with Ohio Valley. When OVU secured that $17 million in financing in 2007, one of the parties to snap up a piece of the bond offering was the KS Foundation of North Canton, Ohio. In exchange for $25,000 in financing, the foundation secured an obligation from OVU to be paid back its $25,000 at 9-percent interest. Acting as one of two trustees of the KS Foundation was J. Kevin Ramsey; his wife was the other.

In other words, from August 31, 2007, until the end of his time on OVU’s board in the 2012-13 academic year, Ramsey, a key member of Ohio Valley’s governing board and its vice chair for finance, also operated a foundation that OVU was — and still is — indebted to.

Ewan White for The Chronicle

Ramsey said his concurrent roles as creditor and vice chair of finance hadn’t created any conflicts of interest. The primary purpose of the KS Foundation, Ramsey said, was to finance scholarships at OVU, and his pay from the foundation hovered around a few thousand dollars a year. Though he couldn’t recall definitively, Ramsey said it was unlikely that he would have informed administrators or fellow board members of his foundation’s purchase. Hopkins, who was then the board chair, couldn’t recall Ramsey’s ever having made such a disclosure to the board.

“I was a private investor who decided that I was going to invest some of the money that I managed,” Ramsey said. “KS Foundation was our private foundation, and I could invest in anything I wanted to invest in.”

But according to Dean Zerbe, who served as legal counsel for the U.S. Senate Finance Committee, both Ohio Valley and Ramsey owed the public a greater degree of transparency than they’d provided. OVU had an ethical obligation, Zerbe said, to acknowledge when any board member’s loan of goodwill turned into a lucrative investment. And at the bare minimum, Ramsey’s fellow trustees deserved to know about his foundation’s investment in OVU’s bonds. “You just absolutely need to belt-and-suspender it in terms of openness and transparency,” Zerbe said.

“Where problems start is when you take the sharp pencils out and say, ‘Well, there’s nothing requiring me to do this.’ Or, ‘I found this exception,’” Zerbe said. “That’s not where you want to be.”

Coal. Over 4 million tons of it.

Beneath 735 acres of northern West Virginia land sits an estimated 4.3 million tons of “clean recoverable coal,” according to a geological analysis by Consol Energy, a publicly traded coal company. It is part of one of the most extensive coal beds in the Appalachian Basin. OVU’s section of the coal seam had yet to be mined by 2007, and the university’s leaders were exuberant about the returns it would see once extraction began.

Rather than conduct their own independent analysis, university leaders relied on coal prices listed in the news releases of its mining partner, Consol Energy, to speculate about future royalty payments to the university once mining began. That back-of-the-envelope arithmetic suggested the mine’s payout might one day total anywhere from $10 million to $16 million — maybe even higher. “Due to increased demand, coal prices have shown continuous increases over the last two to three years,” the university reported in its financial statements from 2009.

The anticipated revenues from the coal mine also played an important part in the design of OVU’s $17-million bond financing in 2007. Once Ohio Valley’s coal mine started generating returns, investors who acquired Series A bonds, collectively worth $6.75 million, would be paid before any other investors — even if OVU defaulted on those bonds. Ramsey’s foundation was in this group. Next in line were bondholders of Series B, C, and D bonds. The university also pledged its campus assets toward the four sets of bonds.

But Ohio Valley’s vision for its coal-driven future was wildly optimistic.

The university anticipated almost immediate movement by Consol Energy, possibly as soon as the 2009-10 academic year. But by 2012, not a single ounce of coal had been mined from OVU’s land.

And so, Ohio Valley’s then-President Harold Shank made an unusual proposal in mid-December 2012 to the bondholders to whom his institution owed at least $17 million of debt: Donate that money back to OVU. “By doing so before the end of 2012,” Shank wrote, “you will be in position to take full advantage of the current tax benefits for charitable giving.”

OVU’s bondholders appear not to have taken up Shank’s invitation. At the end of that fiscal year, the university still owed them almost $17 million of debt.

This dependence on the recruitment of athletes is nothing new to higher ed, and it has been replicated by hundreds of small private universities and colleges across the country, many of which count on their athletic departments to attract students who might otherwise choose campuses with lower costs or better amenities.

But weaknesses in other parts of the university’s operation were becoming more clear. OVU would be the target of another tax lien, this time issued by the State of West Virginia. In early 2015, the U.S. Education Department would release for the first time a list of institutions targeted for additional financial monitoring — a roster that included Ohio Valley. The college was also placed on probation by its accreditor, the Higher Learning Commission. When it lifted that sanction in late October 2013, HLC noted the university’s continuing “challenges related to the assessment of student learning, finances, faculty and staff evaluation, the associate’s degree programs, the general education program, and program review.”

Ramsey recalled that the Higher Learning Commission had “bent over backwards to help the school” while he served on OVU’s board. “They were really good, even though we did not obtain the proper numbers when it came to their particular evaluation method,” Ramsey said. “You put in certain details, and they grade you accordingly. And we continually fell below that.”

The West Virginia Higher Education Policy Commission also repeatedly noted deficiencies in the university’s operations. “Ohio Valley University’s financial health is weak,” an assessment from 2014 concluded. But it went on to say that the administration had put in place the necessary strategies for improvement, before reauthorizing the institution to continue to offer degrees.

Carolyn Fast, a senior fellow at the Century Foundation, said accreditors and regulators like the HLC or the West Virginia commission are often too hesitant to act against failing institutions out of fear that their interventions might force closure. But such restraint carries its own risks.

“It’s a difficult position for all oversight bodies, because the goal isn’t to shut down the school,” Fast said. “They’d rather the school be able to continue operating. But sometimes it’s too late by the time they take action.”

Both the Higher Learning Commission and the West Virginia commission declined to respond substantively to Ramsey and Fast’s comments, though the regulators did point to the actions they took in 2020 and 2021 to protect employees, taxpayers, and students’ families.

Back at Ohio Valley, HLC’s decision to place the university on probation had put a scare into Gail Hopkins, who was then the board chair — and his unease failed to abate even after the regulator lifted its sanction. The possibility that Ohio Valley might soon be forced to close loomed ever-present in Hopkins’s mind. The university needed to come up with a new play, fast.

Enter Marcus Wiley, an engineer and a fellow member of the Churches of Christ, whom OVU enlisted in the fall of 2012 to review the university’s coal stock and 20-year mining lease with Consol. A member of Oklahoma Christian University’s board since 2008, Wiley shared Dimick’s concerns about the challenges plaguing small Christian colleges, as well as aspirations to financially insulate them from such threats. Slowly, the pair began to design a new vehicle to save Ohio Valley — one powered once again by coal, but even more complex and audacious than OVU’s past pursuits.

Unveiled in 2016, Ohio Valley’s proposal called for the construction of a commercial-scale facility where coal would be converted into “ultra-clean energy products, including waxes, solvents, fuels, and power.” Wiley and Dimick projected that the facility would be operational by late 2018, capable of producing fuels, hydrogen, and electricity. Carbon-dioxide capture would also be a feature. Rather than burning the coal, the facility would instead use gasification technology co-invented by Wiley and patented by one of his companies.

The facility would create 60 jobs, and serve as a research site, training center, and educational resource for energy-management and business students. The institution’s own curriculum would even be expanded “to include operation and maintenance of a clean energy production facility.” And there would be opportunities for internships.

That wasn’t all. OVU’s leadership envisioned the facility would eventually bolster the university’s cash flows to the tune of $250 million, a prediction passed along to reviewers from the Higher Learning Commission. After debt service, any remaining revenue generated from the facility’s operations would be used to support OVU, Dimick said. Scholarship funds financed from the project’s returns were a distinct possibility, not to mention the ACE foundation’s goal of having “OVU students graduate debt-free.” The project would serve “as a model for other educational institutions.”

But how did OVU intend to take on millions of dollars of new debt without drawing the ire of its accreditor, state regulator, or the federal government?

It wouldn’t.

Instead, a separate nonprofit called ACE Educational Foundation would handle the project’s assets and obligations, with Dimick, Wiley, and Mike E. O’Neal, former president of Oklahoma Christian University, serving as the ACE foundation’s trustees.

And come 2016-17, OVU would start leaning heavily on the foundation. The university’s cash flows had deteriorated so aggressively by then that it could no longer reassure bondholders of its ability to pay down debts. OVU would actually fail to generate any positive net cash flow from its operations (as opposed to investing or financing) by the end of the 2017 fiscal year, a feat it would repeat across the next two fiscal years. Put another way: Despite holding an asset theoretically valued at over $10 million, OVU was failing to generate any money from its operations.

As the university secured its financing, change was also afoot within its C-suite. First came word of President Harold Shank’s resignation. Next, Jeff Dimick would depart, eventually landing a job at Oklahoma Christian University as chief operations officer. However, by virtue of his patron loans, Dimick would still in theory be owed more than $95,000 by OVU. And he would continue on as president and chairman of the ACE Educational Foundation.

Shank was replaced in January 2019 by Michael Ross, whom OVU’s board heralded as someone “who understands the economic necessity of living within the school’s resources and with the courage and leadership capacity to make necessary changes and to inspire greater outcomes.”

By that point, the board had realized that the university needed to make significant adjustments to how it did business. To carry out those adjustments, the board enlisted O’Neal as chief operating officer, while he still served as secretary and treasurer of the ACE foundation. The university’s board empowered him, according to their financial statements, with the “authority to take whatever steps were deemed necessary to return the school to a sustainable model.” Soon after came a spending freeze, job cuts, and plans to reduce the institution’s 59-percent tuition-discount rate. But by then, those pledges were too little, too late.

OVU’s auditor would raise “substantial doubt” about the institution’s ability to survive beyond March 2020. “Whether, and when, OVU can attain profitability and positive cash flows from operations,” the auditor wrote in a March 21, 2019, report, “is uncertain.” By contrast, in a letter written to auditors seven days earlier, OVU’s director of student services said the university planned to nearly double its enrollment, to as many as 1,000 students, within five years.

Three months later, O’Neal’s June 12, 2019, letter arrived in bondholders’ inboxes. In addition to the threats of “bankruptcy” and “fire sales” just over the horizon, O’Neal warned that while Ohio Valley had not yet defaulted in its payments, “it is perhaps just days away from doing so.” Twelve weeks later, OVU would fail to make $360,000 in payments on its bond principal and interest, triggering default. And by the time March 2020 rolled around, the count of missed payments would rise to five.

How many students could have avoided the fallout from the institution’s closure, asked Fast, of the Century Foundation, if accreditor protocol or government regulation had compelled Ohio Valley to disclose these events to potential and current students? Institutions are already required to inform the Education Department when an auditor raises doubt about their ability to remain operational. Fast wondered why that same disclosure isn’t required to be made to students. Similarly, if an institution is warning of its own closure in correspondence with creditors, Fast said it should be legally obligated to relay those same sentiments to students and their families.

Although bond defaults posed a serious threat to Ohio Valley’s viability, it had bigger problems to worry about come the spring of 2020. The university was now carrying ACE’s debts on its books.

It all went back to the terms of ACE’s bonds. In order to secure the $5.2 million in financing, ACE had promised investors that Ohio Valley University would be a guarantor of the foundation’s debt. And nearly all of that debt — $5 million of it — carried a starting interest rate of 10.5 percent. While the debt was secured by land held by ACE, Ohio Valley also agreed to put up as collateral its coal asset and any revenue generated from it — which were the exact same assets and revenues pledged to investors of Ohio Valley’s 2007 bonds. Adding an extra layer of urgency: ACE’s bonds, for which Ohio Valley was the guarantor, came with a rapidly approaching balloon payment of $4.9 million on December 15, 2021.

Why accept such ugly terms? The university was short on both cash and options, Dimick said. Out of desperation, Dimick said he even agreed to be a guarantor of the bonds in his personal capacity when the firm putting the arrangement together demanded it. Better that than tank the deal, he recalled thinking.

But by May 2020, ACE Educational Foundation was most likely out of compliance with the terms of its bond agreement, according to Ohio Valley’s financial statements, resulting in ACE’s debts and interest being listed on the university’s balance sheet as December 15, 2021, ticked closer. Even more troubles lay ahead.

Despite a few glimmers of hope — more than $1 million in pandemic relief, $1.2 million in Paycheck Protection Program loans, and an agreement among some of the institution’s bondholders to suspend most of OVU’s scheduled remittances — O’Neal could see that the time had come to shut down the university. During two meetings with the board in 2020, O’Neal recommended that the institution “close in an orderly fashion.” Instead, OVU’s trustees elected to persevere. Shortly thereafter, O’Neal left the university.

Slowly suffocating under a perpetually increasing pile of unpaid bills and overdue bond payments, Ross, the new president, saw only one way forward: becoming debt-free as quickly as possible — even if that meant some of his employees would go without pay.

“It’s probably the hardest thing that I have to do, is to make that decision every two weeks — to say we can only do so much,” Ross said during his November 2021 address.

Still, OVU had its excesses: The university continued to maintain company cars for both Ross and the university’s chancellor. And then there was the on-campus fund-raiser featuring the former White House press secretary Sarah Huckabee Sanders, whose attendance cost OVU more than $27,000.

The last gasps of a terminally ill university were becoming more and more apparent. The software system it used to store and access student data and records was broken, and the software provider, Ellucian, was in no mood to fix or update it given the university’s unauthorized use of its product across seven years. At the same time, the West Virginia Higher Education Policy Commission and the Higher Learning Commission began to receive complaints from uncompensated employees and frustrated students unable to obtain transcripts. Equally worrisome was the fact that when the HLC asked the university to deal with a complaint the commission had received, Ohio Valley simply failed to respond to the accreditor.

All the while, Madalyn Cutshall, a freshman golfer, continued to be reassured by administrators and supervisors that Ohio Valley would overcome its financial challenges. Cutshall had every reason to question the university’s long-term viability, not only for her own sake, but also because she recruited high-school seniors as part of her campus job. But Cutshall said administrators cast any insinuation that Ohio Valley might soon close as uninformed gossip — just more of the same rumors that had been proved false for more than 40 years. Cutshall said if she had been afforded the same information that O’Neal and OVU gave to bondholders, she never would have attended the university.

“They should have informed every incoming group of freshmen after 2019 that they were in financial trouble. I wouldn’t have been the only one not going there if that were the case,” Cutshall said. “And I’m sure that’s why they didn’t tell people. Because if they had told incoming freshmen, they wouldn’t have incoming freshmen.”

Then there is the $1.4 million in tuition, fees, and loans that 261 former students still owe OVU. The refusal by or inability of these onetime students to settle their debts now represents an impediment to investors like J. Kevin Ramsey, who financed Ohio Valley’s bonds with an expectation of repayment in full. And so, after more than two decades of get-rich-quick schemes dreamt up by administrators and trustees, it may ultimately be Ohio Valley’s former students who confront the reality that its leaders tried to outrun, and make good on OVU’s bets.

Absent from Ohio Valley’s 97-page bankruptcy petition are the names of its former employees and the back wages owed them. The Christian Chronicle reported that an anonymous benefactor had donated $900,000 to Ohio Valley shortly after its closure was announced, to make faculty and staff whole and to keep paychecks coming through the end of 2021.

The fall of 2021 would be OVU’s final semester, after the institution elected not to hold classes this spring. Two weeks after the West Virginia Higher Education Policy Commission revoked OVU’s ability to confer degrees, Ohio Valley voluntarily gave up its accreditation status from HLC. The Department of Education has not yet announced whether the former students of Ohio Valley will qualify for closed-school loan discharges. The department would not comment on the record for this story. Ramsey is awaiting word on how his investment in OVU’s 2007 bonds will be paid back. Jeff Dimick and Mike O’Neal continue to oversee the operations of the ACE Educational Foundation, and they are working with partners to make their original dream for the foundation a reality.

Madalyn Cutshall transferred to Central Ohio Technical College, where she hopes to secure a degree in two years’ time. Brandon Brammer married his college sweetheart in January, and is looking to land a job in ministry. McKenna Schramm has moved into her own place. She wants to own a gymnastics studio one day, where she would also coach.

As for Ohio Valley’s coal asset, questions to Murray Energy about an anticipated mining start date went unanswered. Last anyone heard, excavation won’t begin until 2026, at the earliest.

From California, Gail Hopkins contemplates alternative endings for the story of Ohio Valley University. What might have been? What could have been done differently? Where did it go wrong? But questions just lead to more questions.

“When do you give up hoping that you can save the patient?” Hopkins asked. He likened the slow death of the institution to his wrenching decision to stop trying to resuscitate his dying father.

“There’s a point at which you call it. I stopped the code blue on my father when it was time to stop, because it became apparent we weren’t going to be able to get him back,” Hopkins said. “That’s kind of the way I view this.”

[ad_2]

Source link