The U. of Iowa Leased Its Utilities Operations for $1 Billion. Now, Its Partner in the Deal Is Suing.

[ad_1]

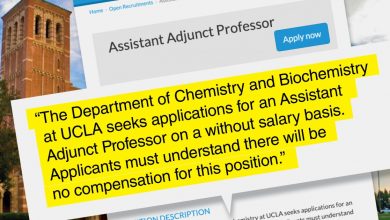

Nearly three years ago, the University of Iowa entered into a $1-billion public-private partnership to lease its utilities operations for 50 years, a deal that the state’s governor hailed at the time as innovative. Last week, the partnership became the subject of a lawsuit.

The partner in that deal, the University of Iowa Energy Collaborative, or UIEC, is suing the university in the U.S. District Court for the Southern District of Iowa for allegedly breaching its contract by wrongfully refusing to make payments, rescinding approvals for repairs to the utility system, and refusing to file insurance claims.

The suit is an example of how such public-private partnerships, or P3s, which have in recent years become popular strategies for public entities to receive upfront infusions of cash, can become fraught. While Iowa’s P3 involved its utilities, higher-education institutions embracing the P3 model have often done so in projects related to housing or parking garages, and at least one of those has resulted in a lawsuit, too.

The contract in question was signed in March 2020, when the University of Iowa sought to lease utility operations to the private sector. After a 10-month bidding process, the board of regents approved a 50-year agreement with two private companies: Engie and Meridiam Infrastructure (they later formed UIEC, a limited liability company). Both companies are French.

Under the agreement, the companies would operate the university’s utilities system, including electricity, water, steam, and cooling services, for an annual utility fee. In return, the university would receive an upfront payment of over $1.1 billion. The institution’s plan would be to invest the money, purportedly so that it would grow to over $3 billion during the 50-year partnership with UIEC.

Around the time the partnership was being reviewed, Iowa’s governor, Kim Reynolds, a Republican, described it as an example of “innovative thinking.” Others were more skeptical. State Senator Joseph Bolkcom, a Democrat, accused the regents of “moving at breakneck speed.” And Claire A. Celsi, also a Democratic state senator, called the board’s decision to vote before the public had a chance to review the proposed partnership “shameful.”

Nonetheless, the contract was signed. UIEC became responsible for operating, maintaining, and upgrading the university’s utilities infrastructure, while the university received the upfront payment of over $1.1 billion. The university used the funding to pay off $153 million in utility-bond debt and $13 million in consulting fees, and added nearly $1 billion to its endowment, according to the lawsuit.

As the deal enters its third year, however, UIEC alleges that the university has “refused to recognize or perform its contractual obligations.” The lawsuit claims the university has refused to pay part of the annual utility fee, which includes an annual fixed fee of $35 million to be increased by 1.5 percent every year starting in 2025, and provisions that allow UIEC to recover money invested for capital improvements, as well as for operations and maintenance.

The lawsuit seeks compensatory damages “in an amount to be proven at trial,” and a variety of other costs, including the salaries, benefits, and bonuses of UIEC’s chief executive and chief financial officer, as well as overhead, which UIEC alleges the university has refused to pay. The executives’ compensation packages totaled $600,000 in 2020, while the operator’s corporate overhead was approximately $275,000 in the first year, according to the lawsuit.

The lawsuit also alleges that the university has refused to fully fund the overhauling of a turbine that was damaged due to the failure of two separate control valves. In addition, according to the lawsuit, the university had agreed to repair the roofs of the main power plant and water-production building. However, after a storm in August 2020 caused additional damage, the university reversed its approval.

‘The Largest Financial Obligation Ever’

In a statement, the university said that the two parties have a disagreement regarding some of the terms and conditions of the deal.

“The university has been working with its utilities partner to resolve these differences,” the statement read. “We are disappointed that our utilities partner has a different interpretation of the contract and felt the need to file a lawsuit against the university. We are eager for the court to provide us with a clear definition of the contract for both parties to adhere to.”

UIEC’s lawyer did not respond to a request for comment.

The Iowa P3 contract was modeled after a 2017 agreement between Ohio State University and Engie. In that agreement, the university got an upfront payment in the same amount as the one received by the University of Iowa. In late 2020, the University of Idaho entered into a similar 50-year pact, becoming the third public university to lease its utility system using the P3 model.

In an audit published in December 2022, Rob Sand, Iowa’s state auditor, expressed concern about the partnership. “In the event the University’s investment of the proceeds does not meet the return on investment needed to pay the amounts due to the concessionaire, Iowa taxpayers may be responsible for making up any shortfall,” Sand wrote. “As a result, this transaction has become the largest financial obligation ever held by Iowa taxpayers.”

The audit also recommended that the governor and the Iowa Legislature closely consider the costs and benefits of such agreements before pursuing similar deals in the future.

[ad_2]

Source link