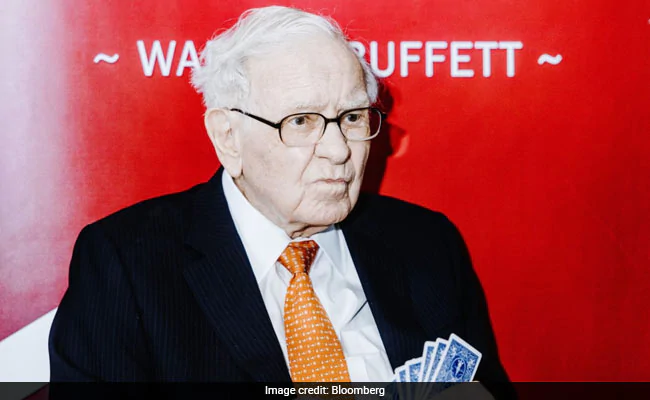

Warren Buffett, chief executive officer of Berkshire Hathaway, Just Wanted To Say Sorry

[ad_1]

Warren Buffett just wanted to say sorry. The chief executive officer made a few blunt admissions at his annual meeting of Berkshire Hathaway Inc. shareholders on Saturday. Among them were regrets over Apple Inc. stock sales, the circumstances surrounding its airline share dump, and a failed healthcare venture.

“That was probably a mistake,” Mr Buffett said of its decision to sell some of the iPhone maker’s stock last year. The move was also deemed an error by his business partner Charlie Munger, who had let Mr Buffett know of his view “in his usual low-key way,” Mr Buffett joked at the virtual meeting.

Mr Buffett, 90, is no stranger to contrition. A portion of his shareholder letter in February was devoted to explaining his “big” error in overpaying for airplane-parts maker Precision Castparts. But this year’s annual meeting was peppered with the acknowledgment of missteps, even after its businesses posted a strong quarter with earnings hitting the second-highest level in data going back to 2010.

“He and Mr Charlie have always tried to admit their mistakes and face their mistakes,” said James Armstrong, who manages assets including Berkshire shares as president of Henry H. Armstrong Associates. Mr Buffett also kept “trying to gently remind us that most of Berkshire’s money is invested well,” he said.

Airline Stocks

The billionaire faced questions over why Berkshire didn’t seize upon the temporary market downturn starting in late March last year to snap up more stocks at depressed prices. Instead, the conglomerate used the first weeks of the U.S. shutdowns to dump its airlines stocks as the pandemic curbed travel and, later in the year, trimmed its bank holdings.

Stocks of Delta Air Lines and Southwest Airlines, two carriers Berkshire owned, had then rallied more than 45 per cent after the end of May through the rest of 2020.

“I do not consider it a great moment in Berkshire’s history,” Mr Buffett said of the period, adding that the economic recovery had surpassed their expectations, thanks to government stimulus measures.

Mr Buffett also said it would have been hard for those carriers to get the federal aid that rescued them if a rich investor was considered a significant shareholder in those companies. He still wouldn’t invest in airlines given current pressure on travel, he told investors on Saturday.

And while Mr Buffett made some deals including a bet on natural gas assets, he didn’t strike any particularly substantial acquisitions despite the pandemic’s pressure on some businesses. For his part, Mr Munger explained that it would be too high a standard to think that money managers can always perfectly time the bottoming of a market to put lots of money to work.

There were examples of contrition in Berkshire’s other businesses, too. Ajit Jain, a vice chairman who runs the company’s insurance operations, said that auto insurer Geico had been late to adopt telematics, the devices used to track drivers and reward them for better behavior.

“Geico had clearly missed the bus and was late in terms of appreciating the value of telematics,” Jain said. “They have woken up to the fact that telematics plays a big role in matching rate to risk.”

In a broader statement on the industry, Jain noted how insurers had underpriced pandemic risks, requiring that they now recalibrate their models. The industry will likely be more sophisticated in thinking about pandemic risk in their entire portfolios, he said.

‘Tape Worm’

Mr Buffett also reflected on the health care venture Berkshire had set up with JPMorgan Chase and Amazon.com, to attack the “tape worm” of high-costs in the system. The venture ultimately closed this year and Mr Buffett acknowledged on Saturday the challenges of trying to overhaul an industry with so many stakeholders, and that accounts for a significant part of the country’s gross domestic product.

“We were fighting a tapeworm in the American economy and the tapeworm won,” Mr Buffett said.

The mea culpas were also accompanied by criticisms and quips from both Mr Munger and Mr Buffett. The boom in SPACs, or special purpose acquisition companies, would probably not last, said Mr Buffett, while Mr Munger took aim at cryptocurrencies and the explosion in retail trading. The pair chided professionals that push people who are just following a natural human instinct to gamble.

“That is really waving the red flag at the bull,” Mr Munger said.

(Except for the headline, this story has not been edited by NDTV staff and is published from a press release)

[ad_2]

Source link