What eToro’s investor presentation and $10B valuation tells us about Robinhood – TechCrunch

[ad_1]

Trading platforms are being valued like high-margin video games

Amid all the news of the last few days, you might have missed that eToro, an Israeli consumer stock-trading service, is going public in the United States via a SPAC.

Don’t worry about the SPAC bit: If you want a rundown of the deal itself, Mary Ann has you covered. What matters for our purposes is that eToro competes with Robinhood in the United States, though it retains a strong European user base. And, thanks to the fact that it is SPACing itself onto the public markets, we now have lots of its financial data to play with.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

You can see where we’re going with this. With Robinhood somewhere between a sheaf of lawsuits and an IPO, the eToro data could provide an interesting insight into the world in which its zero-cost trading competitor operates. If we want to better understand Robinhood, perhaps eToro can provide some clarity.

We’re going into the eToro investor deck, first asking ourselves what we think of its numbers and financial health and valuation. Then we’ll compare what we learned against what we know about Robinhood’s own business. Let’s go!

We’re going into the eToro investor deck, first asking ourselves what we think of its numbers and financial health and valuation. Then we’ll compare what we learned against what we know about Robinhood’s own business. Let’s go!

eToro is going public

The eToro-SPAC deal is a big one, weighing in at over $10 billion in calculated value. Whether the markets will support the valuation isn’t clear, but the debut matters for the Israeli startup market and the returns of a goodly number of venture capitalists and other capital pools.

What do its SPAC-backers see in eToro that could be worth so much? Let’s get into the deck, which you can open up here.

To illustrate both its recent growth and also how relaxed the rules are on what companies can share in their SPAC presentations, eToro has included its full-year 2020 results and its January 2021 results. Why? Because, like Robinhood and others, it had a big start to the year. So, eToro wants to show off how well.

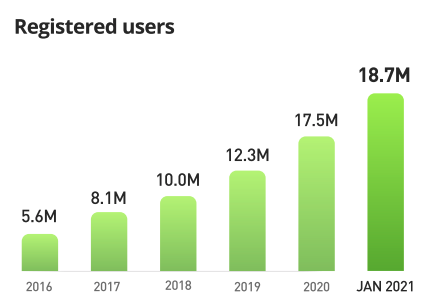

For example, this chart shows that eToro had a good 2020, and an incredible start to 2021:

Image Credits: eToro

Impressive, right? eToro later breaks the 2020/2021 split into numbers, noting that it recorded an average of 192,000 registrations per month in 2019, 440,000 per month in 2020 and 1.223 million in January 2021. The implication the company is trying to impart on investors is obvious: If you like our past growth, just look at what this teaser 2021 data point could mean!

[ad_2]

Source link