Your Future Landlord Just Outbid You for That House

[ad_1]

It’s no secret that rising prices and shrinking inventory have made it difficult to bid successfully on a home. The news that investors are increasingly winning those bids should offer no solace to frustrated home shoppers.

During the third quarter of 2021, investors bought more than 18 percent of the homes sold in the United States — about 90,000 homes in all, for a total of about $64 billion. That’s the highest share and the largest number in any quarter on record, according to a new report by Redfin.

“Investors have the advantage because they usually come with cash,” said Daryl Fairweather, chief economist at Redfin. “They are usually willing to wave inspections. An investor is able to offer terms that are more favorable than an owner occupant.”

The study also found that investors were buying more expensive homes than in the past; the average investor home purchase in the third quarter cost $438,770, about 5 percent more than the average a year earlier. That means investors are profiting from higher rents paid by middle-class earners who in another era may have had an easier time buying themselves.

“The people who own homes these days have very good credit. They’re putting a lot of money down, and people who don’t have that are being shut out,” noted Ms. Fairweather. “That creates an opportunity for investors to buy homes and rent them back to the very people that would have wanted to buy them.”

Rising investor share is nothing new. In Q3 2000, investors bought only about 6 percent of available homes; by the beginning of 2020, just before the pandemic, their share peaked at 16.6 percent. After taking a pandemic dive, the share roared back to the current record 18.2 percent, essentially catching up with the prior trajectory of investor purchases.

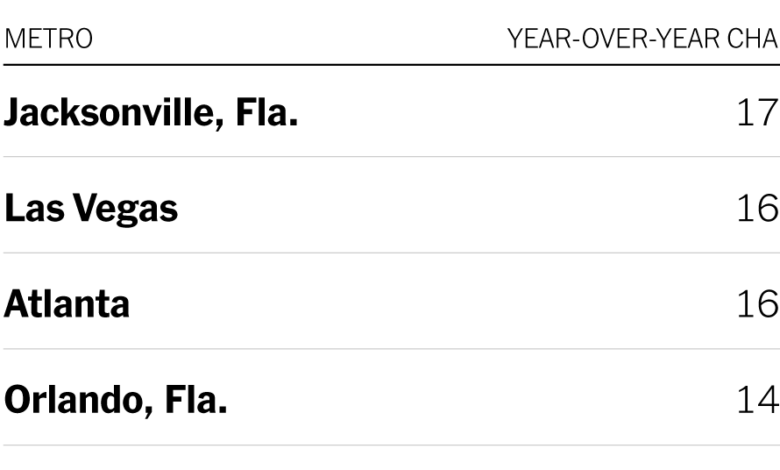

To reach their conclusions, Redfin analysts searched sales records and deeds for telling keywords in the names of purchasers, such as “LLC,” “Inc,” “Trust, ” “association,” company” and “corporate trustee.” The study covered the 50 largest metropolitan areas in the United States, though only 40 could be used because of laws prohibiting records access. This week’s chart shows the 20 metropolitan areas in which investor home purchases increased the most over a year, according to the report.

[ad_2]

Source link