Cabinet Clears Development Finance Institution With Capital Infusion Of Rs 20,000 Crore

[ad_1]

Development Finance Institution have some tax benefits for a 10-year long period

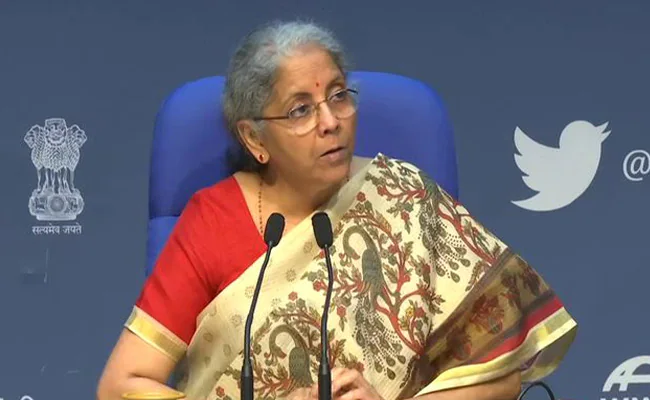

In order to boost the infrastructure development of the country, the Union Cabinet headed by Prime Minister Narendra Modi on Tuesday approved the formation of the Development Finance Institution. The cabinet cleared the setting up of the Development Finance Institution (DFI) with a capital infusion of Rs 20,000 crore, announced Finance Minister Nirmala Sitharaman in a cabinet briefing on Tuesday, March 16. The Development Finance Institution will help raise long-term funds. It will also have some tax benefits for a 10-year long period, said Ms Sitharaman. The proposed legislation will give effect to the announcement made by Finance Minister during her Budget 2021 speech on February 1.

According to cabinet briefing, the initial grant will be Rs. 5,000 crore and additional increments of the grant will be made within a limit of Rs 5,000 crore. The DFI will have a professional board and 50 percent of them will be non-official directors. Initially, the new institution would be owned by the government, and its stake will be cut gradually to 26 per cent.

The Finance Minister added that the government is also planning to issue some securities to the Development Finance Institution, by which the cost of funds will come down. This will help the DFI leverage initial capital and draw funds from various sources and will also have a positive impact on the bond market in the country. The DFI will seek to raise funds from global pension and insurance sectors for investment in new projects and will also have tax benefits.

The Finance Minister in her budget 2019-20 speech, had proposed a study for setting up of Development Finance Institutions for promoting the infrastructure funding. Around 7,000 projects have been identified under the National Infrastructure Pipeline (NIP) with a projected investment of Rs 111 lakh crore during 2020-25.

“This is a very important initiative for bolstering the financing needs of the infrastructure sector. Relieving the banks of the asset-liability mismatch inherent in bank lending to infra, this institution should be enabled to provide long-term capital for the infra sector,” said Soumitra Majumdar, Partner, J Sagar Associates.

”On the liability side, it should be permitted to access all forms of long-term capital, domestically as well as internationally. The bank needs to be manned by finance and sector experts, for effective monitoring of the projects,” added Soumitra Majumdar.

[ad_2]

Source link