RBI Keeps Key Rates Unchanged, Says Recovery “Uncertainty” Due To Covid

[ad_1]

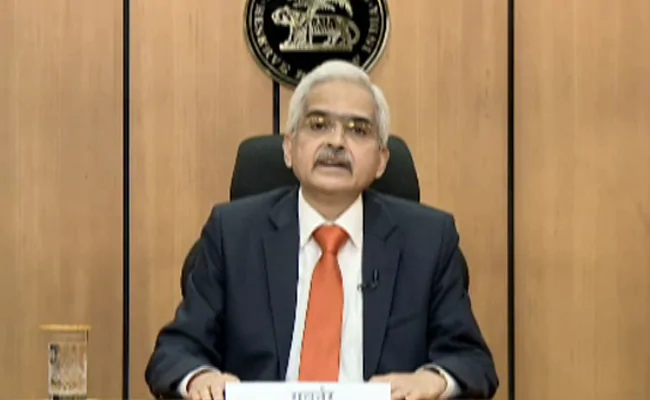

The RBIGovernor also said the bank willcontinue with an accomodative stance

Reserve Bank of India Governor Shaktikanta Das has kept the key rates unchanged, amid a surge in Covid-19 cases and imposition of fresh restrictions to curb the virus. The central bank kept the repo rate – the key interest rates at which the RBI lends money to commercial banks – unchanged at 4 per cent and the reverse repo rate – the rate at which RBI borrows from banks – untouched at 3.35 per cent. The RBI Governor also said the bank will continue with an accomodative stance “as long as necessary to mitigate the impact of the COVID-19 pandemic”.

The central bank governor Shaktikanta Das said the Monetary Policy Committee (MPC) voted unanimously to keep the policy rates unchanged, at its 3-day review meet that began on Monday.

The recent surge in Covid19 cases must be closely watched, the RBI Governor asserted.

The central bank had last cut its policy rates on May 22, 2020, in an off-policy cycle, when India was in the caught in the 1st wave of the dreaded Covid-19 pandemic. The Reserve Bank has slashed its key lending rate i.e. repo rate by 115 basis points since March 2020 to cushion the economy from the shock of coronavirus crisis.

Meanwhile, the annual retail inflation rate rose to 5.03 per cent in February, a three-month high due to the rise in fuel prices, and analysts are worried that high commodity prices could push inflation higher in coming months.

[ad_2]

Source link