Where Are Real Estate Taxes Lowest (and Highest)?

[ad_1]

The coronavirus pandemic has closed many doors over the past year, from restaurants to gyms, theaters and offices. But it has also opened some new opportunities thanks to the expansion of video technology and remote work, which employers are now embracing. Demand for new homes is spiking around the country, and many at-home workers, unbound from their commutes, are free to consider moving anywhere that fits their budget.

But before you get too excited about that house in the country, which seems to cost about the same amount you’d get for selling your apartment, check the property taxes. They may just be off the charts.

For a sense of what’s affordable, check out WalletHub’s recent rankings of median property taxes in all 50 states and the District of Columbia, which were determined by using the latest available U.S. census figures (2019) for median home values and median property taxes paid.

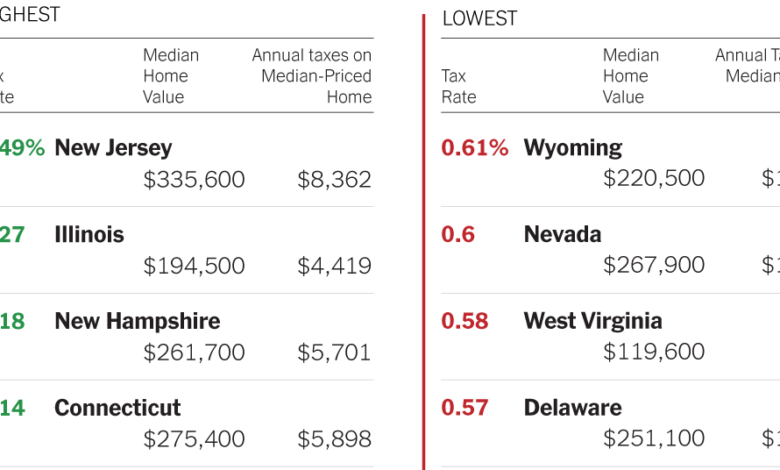

The average American household spends $2,471 on property taxes each year. In the places with the highest median property taxes, the monthly tax payment on a median-price home is often more than half the mortgage payment. Topping the list is New Jersey, where the median-priced home was valued at $335,600. For this house, a 30-year-fixed mortgage at 3.25 percent with a 20 percent down payment would require a monthly mortgage payment of $1,168, plus about $696 in real estate taxes. Once you know the tax rate, an online mortgage calculator, like ours can determine monthly payments at any interest rate and price.

But property taxes aren’t that simple. They’re often imposed not just by states, but by cities, counties and local school boards too. In some areas, like many of New York City’s suburbs, home prices and tax rates are well above the state median. Also, today’s prices may be higher than those in the study, given the suburban real estate boom that has unfolded amid the pandemic. Finally, build in a buffer for increases, because tax payments, unlike those for many mortgages, are not fixed — your state or county will reassess the value of your property eventually.

This week’s chart, based on WalletHub’s findings, shows the states where real estate taxes are highest and lowest.

For weekly email updates on residential real estate news, sign up here. Follow us on Twitter: @nytrealestate.

[ad_2]

Source link