Alphabet’s CapitalG leads $40 million round in fintech Mantl – TechCrunch

[ad_1]

Community banks and credit unions aim to be the heart of the, well, communities, they serve. But without the big budgets of larger institutions, keeping up technology-wise can be a challenge. And not only are they competing with legacy players, there is also a slew of digital banks that have emerged in recent years, as well.

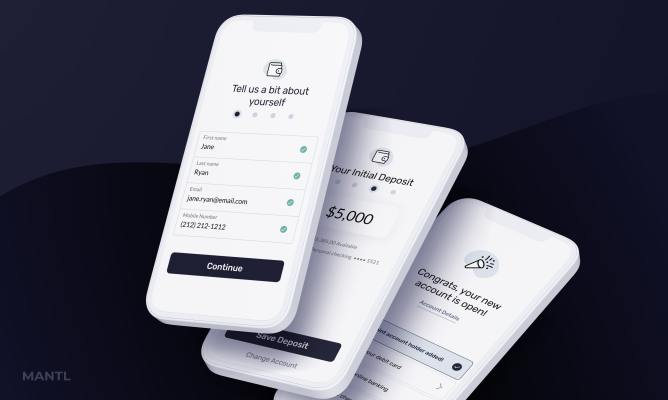

Enter Mantl, a startup that has developed technology to make it easier for people to open accounts digitally at community banks and credit unions so that those institutions can increase deposits and ultimately, profits. Founded in 2016, New York-based Mantl has been described by some as “the Shopify of account opening.”

Community banks and credit unions make up a big percentage of all banking institutions, which means Mantl’s market opportunity is pretty darn large. The fintech’s revenue increased by 213% in 2020 as financial institutions clamored to meet increased demand for digital offerings from consumers in the wake of the COVID-19 pandemic.

And today, the company is announcing it has raised $40 million in a Series B round of funding led by Alphabet’s independent growth fund, CapitalG, to help it grow even more. The financing brings Mantl’s total funding raised since inception to $60.7 million and included participation from D1 Capital Partners, BoxGroup and existing backers Point72 Ventures, Clocktower Technology Ventures and OldSlip Group. The company raised $19 million last July after growing deposit volume by 705% in April of that year.

The startup declined to reveal hard revenue figures.

Mantl originally set out to build its own challenger bank, but in doing so realized there are 10,000 banks and credit unions in the U.S., and that 96% of them outsourced their technology to third-party legacy vendors such as Fiserv and Jack Henry, many of which have technology that is in some cases “decades old,” according to Nathaniel Harley, co-founder and CEO at Mantl.

Such outdated technology has kept many financial institutions such as community banks and credit unions from competing online, and also limits the digital banking options available to consumers, the company said.

So the company pivoted, based on the premise that most community banks and credit unions are critical to maintaining competition and equity in the United States’ financial system.

“At a high level, Mantl is an enterprise software company that is really focused on helping traditional financial institutions modernize and grow,” Harley told TechCrunch. “Our mission at the end of the day is to really expand the access to financial services by taking on the legacy infrastructure, which has really hindered access to digital banking.”

The company claims that its white-labeled account opening software allows banks and customers “to open an account from anywhere at any time, on any device in less than three minutes.”

Through its flagship account opening software, Mantl claims to have helped community institutions — many of which are competing online for the first time — establish efficient and profitable digital operations. Among the community banks it works with are Cross River Bank, Quontic and Midwest BankCentre.

“Banks are naturally very risk averse, and we need to build in order to fully take on that full infrastructure that they’re working in,” Harley said. “Account opening is low risk, but it’s also extremely high value considering that less than 50% of banks actually have online account opening today.”

Mantl integrates directly into the legacy infrastructure, also known as a core banking system, in order to enhance that system and help institutions launch digital products quickly.

The company says its software also automates application decisioning for over 90% of cases while also reducing fraud by more than 60%. This results in deposit growth that’s “typically 4x faster than other solutions on the market and up to 10x more cost-effective than building a new branch,” the company said.

Combined, the institutions it works with have onboarded hundreds of thousands of new customers and raised billions of dollars in core deposits, the company claims.

“We’re challenging the legacy infrastructure that is holding community institutions back,” Harley said,” and we see account opening as just the beginning.”

The startup plans to use its new capital to do some hiring and expand its product offerings, including software that it says would be able to improve and digitize the onboarding experience for not just financial institutions but businesses of all sizes, from sole proprietors to complex commercial enterprises.

CapitalG partner Jesse Wedler shares Mantl’s belief that banks form the backbone of this nation’s economy, both on a local and national level.

“While digitization has long been a priority for banks, it has become an urgent imperative as branches close and digital disruptors grow,” he said.

As CapitalG reviewed the landscape of companies helping banks with digital transformation, Mantl stood out, Wedler said, due to its “user experience, resulting deposit growth and time-to-value for banks of all sizes.”

But what has his firm most excited, he added, is the team’s vision for “transforming adjacent core banking applications.”

Since its founding in 2013, CapitalG has invested in a number of fintechs, including MX, Stripe, Robinhood, Credit Karma, Albert, Aye Finance and LendingClub.

[ad_2]

Source link