Mio, a social commerce startup focused on smaller cities and rural areas in Vietnam, raises $1M seed – TechCrunch

[ad_1]

Vietnam has one of the fastest-growing e-commerce markets in Southeast Asia, but many major platforms still focus on large cities. This means people in smaller cities or rural areas need to deal with longer wait times for deliveries. Social commerce company Mio is taking advantage of that gap by building a reseller network and logistics infrastructure that can offer next-day delivery to tier 2 and 3 cities.

The startup, which currently focuses on fresh groceries and plans to expand into more categories, announced today it has raised $1 million in seed funding. The round was co-led by Venturra Discovery and Golden Gate Ventures. Other participants included iSeed SEA, DoorDash executive Gokul Rajaram and Vidit Aatrey and Sanjeev Barnwal, co-founders of Indian social commerce unicorn Meesho.

Rajaram, Aatrey and Barnwal will become advisors to Mio co-founder and chief executive officer Trung Huynh, former investment associate at IDG Ventures Vietnam. Other founders include An Pham, who also co-founded Temasek-backed logistics startup SCommerce, Tu Le and Long Pham.

Founded in June 2020, Mio now claims hundreds of agents, or resellers. They are primarily women aged 25 to 35 years old who live in smaller cities or rural areas. Most join Mio because they want to supplement their household income, which is usually below $350, Huynh and Venturra investment associate Valerie Vu told TechCrunch in an email.

The social commerce model works for them because they are part of tight-knit communities that are already used to making group orders together. On average, Mio claims that its resellers make about $200 to $300, earning a 10% commission on each order, and additional commissions based on the monthly performance of resellers they referred to the platform.

Mio is among a crop of social commerce startups across Asia that leverage the buying power of areas where major e-commerce players haven’t reached dominance yet. For example, lower tier cities fueled Pinduoduo’s meteoric rise in China, while Meesho has built a distribution network in 5,000 Indian cities. Other examples of social commerce areas focused on smaller cities and rural areas include “hyperlocal” startup Super and KitaBeli, both in Indonesia, and Resellee in the Philippines.

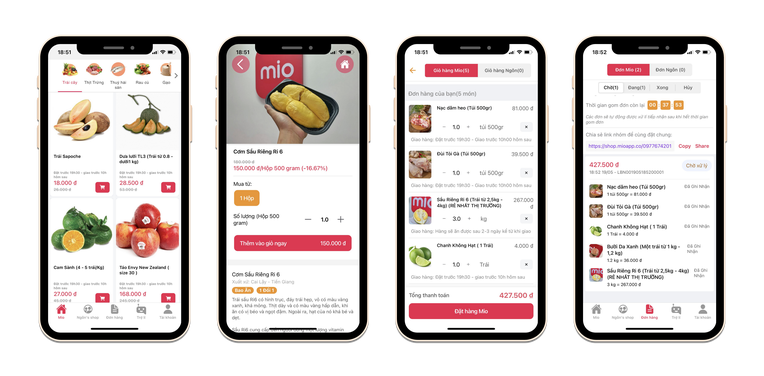

Social commerce companies typically don’t require resellers to carry inventory. Instead, resellers pick what items they want to market to their buyers. In Mio’s case, most of their resellers’ customers are friends, family members and neighbors, and they promote group orders through social media platforms like Facebook, TikTok, Instagram or Zalo, Vietnam’s most popular messaging app. Then they place and manage orders through Mio’s reseller app.

To address delivery challenges, Mio is building an in-house logistics and fulfillment system, including a new distribution center in Thu Duc that can distribute goods to all of Ho Chi Minh and the surrounding five cities in Binh Dong and Dong Nai provinces. Vu and Huynh said Mio can process up to tens of thousands of daily order units at the center. Mio is also able to perform next-day deliveries for orders that are made prior to 8PM.

To lower logistics costs and ensure quick delivery times, Mio limits the number of products in its inventory. The company currently focuses on grocery staples, including fresh produce and poultry, and plans to add FMCG (fast-moving consumer goods) and household appliances, too, especially white-label goods that have a higher profit margin.

Mio’s new funding will be used on its distribution center, and hiring for its tech and product teams. The startup plans to add more personalization options for product categories and resellers, so they can build their own brand identities.

[ad_2]

Source link