U.S. Education Department Will Relax Aid-Verification Rules in 2021-22

[ad_1]

The change, intended to ease the challenges students and institutions are experiencing because of the pandemic, means that fewer low-income students will have to provide additional proof that their financial information is accurate. In a July 13 “Dear Colleague” letter describing the change, an Education Department official wrote that the verification process would focus on stamping out identity theft and fraud.

That thunderous sound you hear? It’s college-access advocates applauding like mad. After all, verification is a procedural barrier that disproportionately hinders low-income and underrepresented applicants.

“This change is great news for students and for those who support them,” said Carrie Warick director of policy and advocacy for the National College Attainment Network, known as NCAN. “Students from low-income backgrounds who should be receiving need-based aid will be able to access that aid without having to jump through additional hoops to get it.”

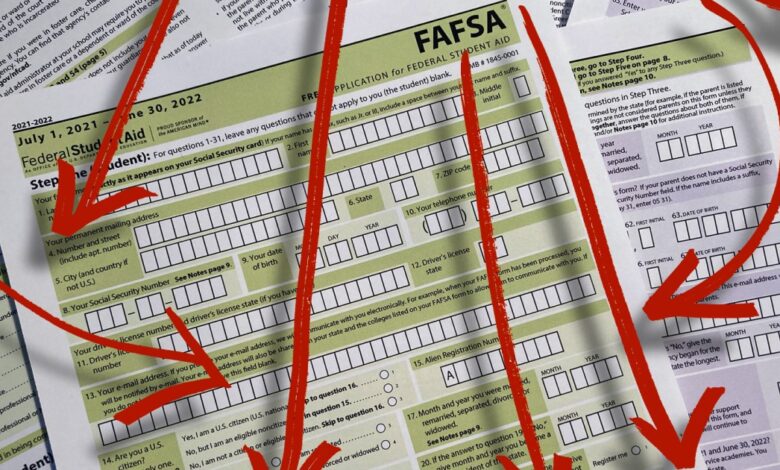

For those lucky souls who haven’t dealt with verification firsthand, let’s review. Students and parents must complete the Free Application for Federal Student Aid, or FAFSA, to get government grants, scholarships, and loans. Each year, the Education Department’s Federal Student Aid office, known as FSA, requires many new and returning students to complete an audit called verification. Each applicant selected for the process must submit additional financial information, such as tax transcripts, to colleges, which then must verify the accuracy of each FAFSA flagged for review. Students must comply to get their aid.

The process is meant to reduce fraud, correct errors, and ensure that the proper amounts of taxpayer money go to the right people. But many critics of verification have long argued that it places undue obstacles before students trying to get to (and through) college. As The Chronicle described in an extensive 2017 article, the “verification trap” snares many disadvantaged students who often must navigate the process, by tracking down tax documents and completing confusing forms, with little or no help from their families or counselors. For some applicants, the process is arduous — and it can take an emotional toll. “We’re essentially asking poor people to prove that they’re poor over and over again,” one researcher told The Chronicle, “that their life is as complicated as they say it is.”

Typically, more than three million federal-aid applicants are chosen for verification in each cycle, according the Education Department. But the percentage of students selected has been declining in recent years. In December, FSA announced that it was using a more-targeted approach to verification — and that it would reduce the number of applicants it selected in 2021-22 to 18 percent. Over the previous two enrollment cycles, it had selected 22 percent, down from a high of 38 percent from 2011-12 to 2017-18.

“The costs of doing verification,” a slide presented at an FSA conference last year said, “exceed the benefits when we verify for more than 18 percent of FAFSA filers.”

Consider this: The Internal Revenue Service audited less than 1 percent of all federal tax returns in 2019.

And some applicants are much more likely to be selected than others. A recent Washington Post analysis of federal data found that the Education Department for at least a decade had been disproportionately selecting students from majority Black and Latino neighborhoods for verification.

In the past, about two-fifths of Pell-eligible FAFSA applicants have been selected for verification. In some cases, they don’t go on to receive federal aid, a problem known as verification melt. According to a recent estimate from the Federal Student Aid office, 7.2 percent of students selected do not end up receiving a Pell Grant or other federal aid as a result of the process.

Some of those students might have been deemed ineligible for aid. But as Bill DeBaun, director of data and evaluation at NCAN, wrote in a recent blog post about verification melt, other students “may have encountered the attrition due to frustration or uncertainty about the process that NCAN members see every day across the country.”

Though the overall selection rate will drop in 2021-22, it’s not clear by how much, said Warick, who cautioned against viewing the change as an sign that families could more easily game the federal-aid system: “This change is going to dramatically reduce the number of students who need to complete the verification process, but it is not a free ride in which someone will be able to get a Pell Grant if they shouldn’t.”

Students — not to mention the school counselors and college advisers who help them complete the FAFSA — aren’t the only ones who will benefit from the one-year change. Many college officials have reason to breathe a sigh of relief, too.

After all, verification places an administrative burden on financial-aid offices, which must oversee the process. In a recently published paper, two researchers estimated that verification costs colleges nearly $500 million annually. Community colleges, which serve a disproportionate number of Pell Grant-recipients, spend a quarter of their operating budgets on the process, compared with just 1 percent at private colleges.

Financial-aid staffs have had long, complicated history with verification, Justin Draeger, president and chief executive of the National Association of Student Financial Aid Administrators, wrote in a message to The Chronicle on Tuesday: “Frustratingly, verification isn’t well targeted and doesn’t actually lead to very many changes in financial-aid awards. Waiving these requirements now means that students who have been stuck in the verification process, and schools that have been working with them, can move straight to putting together a financial-aid package without delay.”

Whether the temporary change will lead to permanent overhaul of the verification process remains to be seen. In a news release, Richard Cordray, the FSA’s chief operating officer, said his division would “continue to evaluate what improvements can be done longer-term to make the verification process more equitable while still preventing fraud.”

The next enrollment cycle just might provide the blueprint for a less onerous process.

[ad_2]

Source link