Want a Profitable Short-Term Rental? Try These Spots.

[ad_1]

For those fortunate enough to own an Airbnb or Vrbo property, 2021 was a stellar year. According to a new analysis by AirDNA, an unaffiliated company that collects and analyzes data from short-term rental listings, 62 percent of such properties were occupied at any given time in 2021 — up 5 percent from 2020 and 10 percent from 2019. And thanks to the increased demand, landlords were able to charge higher rates, earning them an average of 39 percent more annually than before the pandemic.

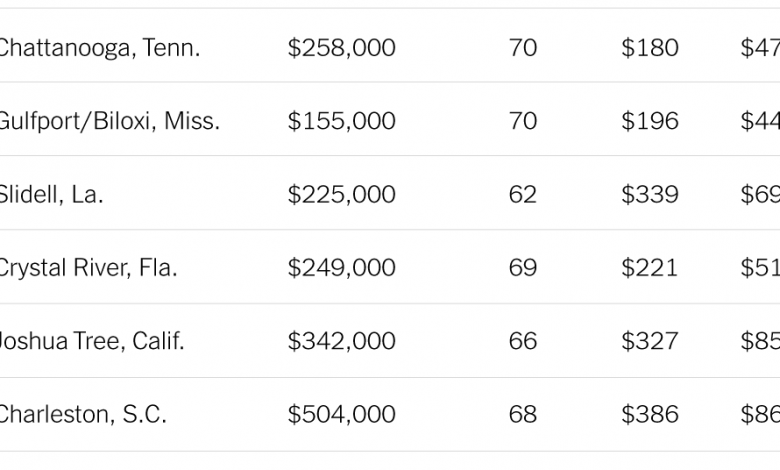

AirDNA used several metrics to find which areas were best for investing in short-term rentals. Demand was one, measured by occupancy rates and the rate at which new listings were added in the area. Next was revenue growth, which compared 2021 rental income to the previous two years. Finally, what the study labeled “investability” weighed the costs of purchasing and operating a property against the income it produced (and also included the number of other short-term rentals in the same ZIP code that would present competition).

Perhaps unsurprisingly, two coastal resort areas — Maui, Hawaii and Alaska’s Kenai Peninsula — topped this list. But overall, it was small cities and rural areas that generated the highest revenue. Mountain and resort areas came next, followed by midsize cities, and then coastal resort destinations like Maui. Large suburban cities and large urban cities showed the least investment potential.

This is good news for current landlords, but it doesn’t much help anyone who’s hoping to jump on the bandwagon. Because inventory is so tight, people looking to buy a short-term rental can expect high prices and stiff competition from other prospective landlords, as well as those hoping to buy a primary residence.

[ad_2]

Source link