Work in Public Education and Hate Chegg? You Might Be an Investor

Think you can sell Juan B. Gutiérrez on Chegg? Probably not.

The University of Texas at San Antonio math professor and department chair is a critic of the ed-tech platform. He says he’s witnessed firsthand how the site’s services can be co-opted by bad actors, and he believes the company owes much of its success and profitability to academic misconduct.

“I definitely condemn that business model,” Gutiérrez said.

Gutiérrez also happens to be an investor in Chegg — one of the more than 1.5 million current and former public-education employees who count on the Teacher Retirement System of Texas to manage their retirement savings.

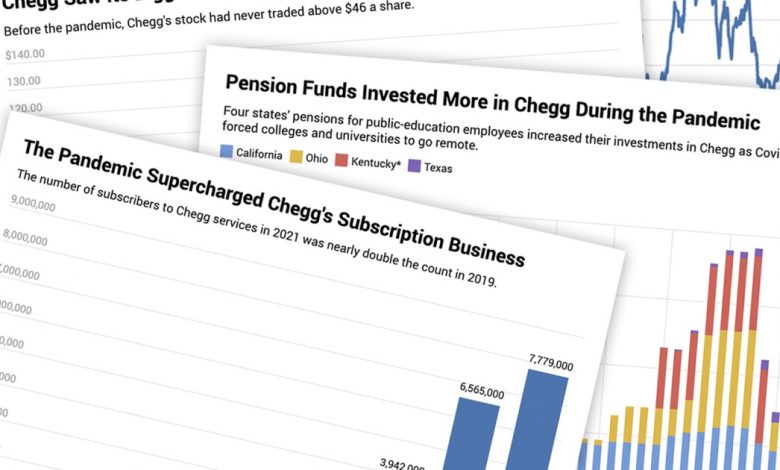

According to the Securities and Exchange Commission, three other state-run pension funds for public-education employees also own shares in the controversial education-technology company: the California State Teachers’ Retirement System (known as CalSTRS), the State Teachers Retirement System of Ohio, and the Kentucky Teachers’ Retirement System. When the value of Chegg’s stock peaked during the first quarter of 2021, the four pensions owned a combined $64-million worth of stock in the company. The systems serve those who work or have worked in public-school education or in higher education. (Other public pension funds also held and continue to hold Chegg shares. However, educators constitute a smaller share of these systems’ membership rolls.)

Higher education is no stranger to controversy and activism around its investment practices. Typically, however, such disagreements center on the institutions themselves, and whether or how much they’ve invested in controversial industries or countries. The investments in Chegg raise concerns about whether the values held by many professors are reconcilable with what’s best for their long-term financial well-being.

Chegg is an education-technology company that was founded by college students in 2005 and focused initially on textbook rentals. It has since expanded to other areas, such as a subscription-based tutoring service that many faculty members see as a conduit for cheating.

Indeed, as Chegg added subscribers to its rolls during the pandemic, alleged incidents of academic misconduct linked to the company also proliferated. At the Georgia Institute of Technology, students allegedly posted final-exam questions to the platform. Chemistry students at Boston University would come under scrutiny next for their use of the Chegg Tutors feature. And in an interview with the campus newspaper last year, a University of Oregon instructor recalled busting one student who had used Chegg services on an exam.

When asked about criticisms of its platform and its relationship to cheating, a representative for Chegg said in a statement that the company was “committed to academic integrity, which we believe is fundamental to the learning process and core to our mission of providing students with the support they need to navigate their own academic journeys and succeed.”

Drops in the Bucket

The investments in Chegg by these four funds are minor, in terms of the financial activity of both the publicly traded company and of the pensions themselves. For instance, at the close of the third quarter of 2021, the four funds collectively owned 764,000 shares in Chegg — the equivalent of half a percent of Chegg’s outstanding shares. In comparison, 34 institutional investors or investment managers held a greater stake in Chegg than the four pensions put together.

Similarly, the enormous size of the four pension funds means that the returns or losses from trading Chegg stock are negligible. Sure, $18-million worth of Chegg stock held by the Kentucky TRS at the close of the first quarter of 2021 might sound like a lot, but not for a fund with an estimated $10.1-billion in assets under management at the time. Kentucky’s $18 million is the largest reported investment in Chegg at quarter-end by any of the four pensions — but it was still a tiny percentage of the estimated value of the investments in the Kentucky TRS portfolio on the last day of the first quarter of 2021.

Beau Barnes, the deputy executive secretary and general counsel at the Kentucky TRS, said he was not aware of any complaints received by the pension from its members concerning the system’s investment in Chegg. Regardless, the pension’s investments in the company aligned with the fund’s fiduciary responsibilities to its members, Barnes said — “to invest in the best financial interest of the system and its members by seeking good investment returns within acceptable levels of risk.”

Thomas Lawrence, senior information officer at CalSTRS, expressed a similar sentiment.

“CalSTRS makes all investment decisions on behalf of the financial future of our members,” Lawrence said. The pension funds in Texas and Ohio didn’t respond to requests for comment as of publication time.

Criticisms of the morality of certain investment vehicles are a perennial subject, both inside and outside institutions of higher education. In 1985, for example, student protests at Columbia University spurred the institution to divest its holdings in all corporations operating in South Africa. Alternatively, the World Wildlife Fund generated controversy in 2018 after the leak of the so-called Paradise Papers revealed the advocacy organization’s investment in a private equity firm specializing in oil and gas, mining, and other energy holdings. More recently, a federal judge ruled Texas couldn’t enforce a ban against government contractors in the state who boycotted Israel.

As for Gutiérrez, the UTSA math professor said he would favor the Teacher Retirement System of Texas not investing in Chegg. Yes, the fund’s ultimate responsibility is to the financial well-being of its members. But other investment opportunities are available beyond Chegg.

“Investing ethically does not necessarily mean investing with less efficiency,” Gutiérrez said. “There are plenty of options that are quite decent and quite profitable.”

Source link