There’s More Demand for Second Homes Than for Primary Homes

[ad_1]

With demand skyrocketing, inventory lagging and bidding wars breaking out all over the country, home prices are naturally heading for the stratosphere. By the fourth quarter of 2020, the national median home price had risen to $346,800, up from $327,400 a year earlier, pricing many potential buyers out of the market.

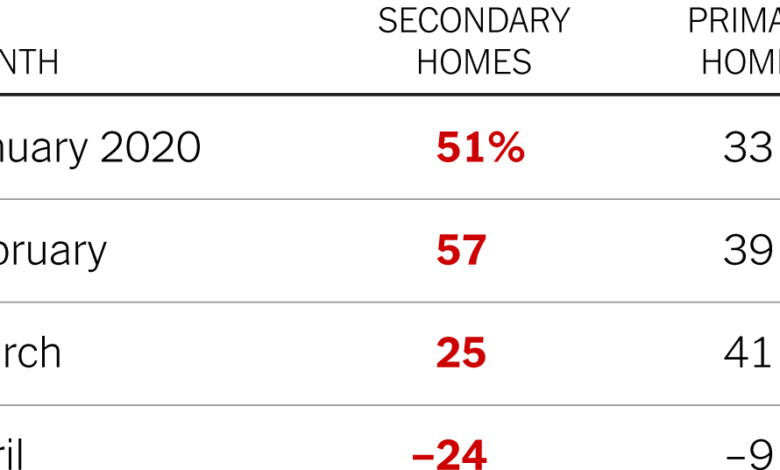

On top of all this, people who want to make a conventional move — swapping one primary home for another — are competing more with others wealthy enough to buy second homes. In fact, demand for second homes far surpassed demand for primary homes between January 2020 and January 2021, according to a Redfin analysis of mortgage application data from Optimal Blue, a real estate analytics firm.

The analysis focused on requests for interest-rate locks by mortgage applicants. A rate lock freezes a pending loan’s rate for a short time, and is typically requested when a purchase is imminent. (Eighty percent of rate-lock requests are followed by a purchase, according to Redfin.) While sales records do not indicate whether a home was purchased as a primary or secondary residence, rate-lock requests do, making them a good indicator of demand.

Increased home demand predates the pandemic. Back in January 2020, rate locks for secondary homes were 51 percent higher than a year earlier, compared to 33 percent higher for primary homes. But as the pandemic set in, the growth in secondary-home rate locks spiked: By September 2020, rate-lock growth for those homes had ballooned by 118 percent year over year, while primary homes had grown by a lesser, though still formidable, 65 percent.

This week’s chart shows the changes in rate-lock requests on applications for primary and secondary homes over the entirety of 2020.

[ad_2]

Source link