Smart lock maker Latch teams with real estate firm to go public via SPAC – TechCrunch

[ad_1]

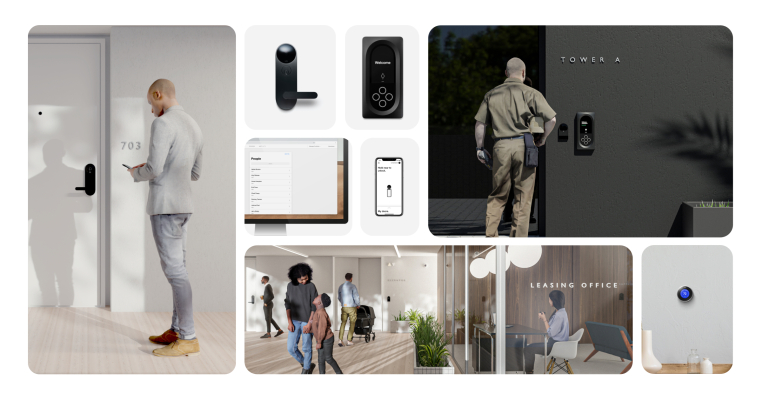

This week, Latch becomes the latest company to join the SPAC parade. Founded in 2014, the New York-based company came out of stealth two years later, launching a smart lock system. Though, like many companies primarily known for hardware solutions, Latch says it’s more, offering a connected security software platform for owners of apartment buildings.

The company is set to go public courtesy of a merger with blank check company TS Innovation Acquisitions Corp. As far as partners go, Tishman Speyer Properties makes strategic sense here. The New York-based commercial real estate firm is a logical partner for a company whose technology is currently deployed exclusively in residential apartment buildings.

“With a standard IPO, you have all of the banks take you out to all of the big investors,” Latch founder and CEO Luke Schoenfelder tells TechCrunch. “We felt like there was an opportunity here to have an extra level of strategic partnership and an extra level of product expansion that came as part of the process. Our ability to go into Europe and commercial offices is now accelerated meaningfully because of this partnership.

The number of SPAC deals has increased substantially over the past several months, including recent examples like Taboola. According to Crunchbase, Latch has raised $152 million, to date. And the company has seen solid growth over the past year — not something every hardware or hardware adjacent company can say about the pandemic.

As my colleague Alex noted on Extra Crunch today, “Doing some quick match, Latch grew booked revenues 50.5% from 2019 to 2020. Its booked software revenues grew 37.1%, while its booked hardware top line expanded over 70% during the same period.”

“We’ve been a customer and investor in Latch for years,” Tishman Speyer President and CEO Rob Speyer tells TechCrunch. “Our customers — the people who live in our buildings — love the Latch product. So we’ve rolled it out across our residential portfolio […] I hope we can act as both a thought partner and product incubator for them.”

While the company plans to expand to commercial offices, apartment buildings have been a nice vertical thus far — meaning the company doesn’t have to compete as directly in the crowded smart home lock category. Among other things, it’s probably a net positive if you’re going head to head against, say Amazon. That the company has built in partners in real estate firms like Tishman Speyer is also a net positive.

Schoenfelder says the company is looking toward such partnerships as test beds for its technology. “Our products have been in the field for many years in multifamily. The usage patterns are going to be slightly different in commercial offices. We think we know how they’re going to be different, but being able to get them up and running and observe the interaction with products in the wild is going to be really important.”

The deal values Latch at $1.56 billion and is expected to close in Q2.

[ad_2]

Source link