A Pandemic-Era Cut With a Hidden Price Tag

[ad_1]

By then Covid-19 had irrevocably warped life in America and on the campus where Tamanaha taught law, Washington University in St. Louis. Campus leaders estimated that by June 30, 2020, the end of its fiscal year, more than $150 million in expected revenue would be lost due to the pandemic, even after more than 2,000 employees had been furloughed. And a hiring freeze, instituted on March 30, 2020, remained in effect and without any known endpoint.

With all of those dark clouds circling overhead, the university decided to minimize job losses as much as possible, by suspending for 12 months its contributions to employees’ retirement plans, a step that would allow it to save $95.4 million in cash. The equivalent savings from work-force reductions “would require eliminating 1,400 jobs at a salary of $55,000 per year,” the chancellor, Andrew D. Martin, and members of his cabinet wrote to university employees in mid-June 2020.

Forgo his retirement match from WashU to save jobs? Tamanaha had no problem with that trade-off.

“I was willing to do my share to help,” he said.

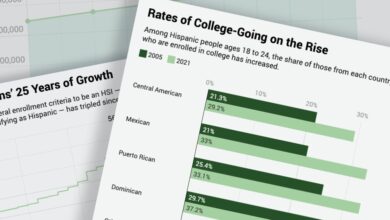

That strategy was adopted widely by other private institutions during the pandemic, and it was deployed alongside such other measures as layoffs, salary reductions, and furloughs. While the long-term price tag won’t be clear for decades, the initial indications are that it could be substantial: A Chronicle analysis of 1,175 retirement plans sponsored by hundreds of private colleges and universities found that employer contributions cumulatively fell by $729 million from 2019 to 2020.

For many institutions, such a spending cut was historic. Never before had WashU, for example, undertaken such an extraordinary move. Not after the September 11, 2001, terrorist attacks or during the 2007-8 financial crisis, or even when the institution faced a $20-million budget shortfall, in 2009.

Can higher ed’s work force count on America’s colleges and universities to return to the old way of doing business? Adrianna Kezar, director of the Pullias Center for Higher Education at the University of Southern California, worries that the answer is no. Contribution suspensions and cutbacks, she thinks, may be used with greater frequency by administrators and governing boards to deal with budget overruns, despite the disproportionate fallout for some members of their work forces.

“There will be a significant impact on younger faculty and staff, since they’re losing out on all that compounded investment income over time,” Kezar said.

Some higher-ed clients of Fidelity Investments have already sought to modify the terms of their retirement-benefits packages, said Nick Amarol, vice president for data analytics and insights for tax-exempt markets at Fidelity. The big change? New leeway to suspend or reduce retirement contributions if need be.

At WashU, at least, an improving financial picture cut short that anticipated yearlong suspension of contributions; payments were resumed after only a four-month freeze. All told, the money spent by WashU on its employees’ retirement plans declined by around $24 million from 2019 to 2020 — a cut in retirement compensation that averaged about $1,500 less per employee for the year.

Now, more than two years later, and after historic investment gains in WashU’s endowment, Tamanaha questions whether the sacrifices that he and his fellow employees made in 2020 were actually even needed.

Around that time, Amarol’s clients at Fidelity were pumping him for information about their options, as they weighed the theoretical savings from a cut in retirement-benefit spending against the impact of such a move on their employees’ long-term readiness for retirement.

“In the early days of the pandemic, surviving the financial stress of the moment was the top priority for most institutions,” Amarol said.

As the storm clouds of the pandemic have begun to clear, many institutions have since reinstated their retirement-contribution benefit for employees, either fully or partly. And some colleges and universities have tried to find ways to restore some or all of the compensation their employees lost during the early response to Covid.

At the Johns Hopkins University, leaders announced in April 2021 that it intended to restore, in full, all retirement contributions that had gone un-deposited since July 1, 2020.

The University of Chicago made a similar commitment in late 2021, promising employees a one-time employer contribution to their retirement accounts, to make up for a six-month suspension earlier that year.

And at Marymount University, in Virginia, all eligible employees received a one-time, 2-percent “catch-up” contribution, as well as a match of all eligible employee contributions, in 2021.

Not every institution may be in a position to reinstate or reimburse retirement contributions. But for those colleges that are, said Kezar, presidents and boards should consider making their employees either fully or partly whole.

“For those institutions who have come out of the pandemic OK, that should be on the table for consideration,” Kezar said. “Leaders with integrity at those institutions should be considering that option.”

Though WashU didn’t specifically restore lost retirement compensation for employees, university leaders were aware of their work force’s sacrifices in 2020. In January 2021, Martin, WashU’s chancellor, announced that the university would both resume its idled merit increases for faculty and staff salaries, and make those increases effective on April 1 of that year rather than on June 30, the end of the fiscal year.

“I felt it was important to make this happen as soon as possible in an effort to replace some of what has been lost during the current year,” Martin wrote to WashU’s work force.

To help offset the university’s financial losses in 2020, Martin and his cabinet also agreed to take pay cuts of 10 to 20 percent, a spokeswoman for WashU said. Many such executives elected to cut their pay in 2020. Still, other institutions chose to sign deferred-compensation deals with their leaders that year.

But Martin saw no interruption in his retirement compensation in 2020. He had already reached the maximum allowed contribution for that year by the time WashU suspended contributions to its employees’ plans, on July 1, said Julie Hail Flory, vice chancellor for marketing and communications. Martin earned $19,950 in retirement compensation in 2020, according to returns WashU filed with the Internal Revenue Service. He also maxed out the university’s retirement contribution in 2019, when he earned $19,600, Flory said.

Near the other end of the spectrum was American University and the 2,500-plus participants in its defined-contribution plan. From 2019 to 2020, the average contribution for each eligible employee fell by $5,400. American double-matches each participant’s contribution up to 10 percent of the employee’s base salary. When it suspended contributions, from August 2020 to June 2021, it spent only $2.1 million on such contributions in that fiscal year, a substantial drop from the $20 million spent in 2019-20. The suspension, combined with salary reductions for university leaders, furlough days, and a significant draw from the university’s reserves, allowed American to avoid layoffs, said Matt Bennett, American’s vice president and chief communications officer.

“Our priority was our people and our community,” he said.

The full cost of the cuts across higher education won’t become clear for years, and possibly decades. Retirement-plan contributions aren’t simply deposited into an account and left there. Funds are traditionally invested in the stock market. Practically speaking, the long-term value of a missing $1,000 can grow enormously over time, depending on the investment vehicle and the fortunes of the market.

For instance, by one estimate, a $1,000 investment in an index fund pegged to the S&P 500 in January 2011 would have generated a nominal (unadjusted for inflation) pretax return of more than $2,000 by December 2020 — assuming dividends were reinvested and fund-management fees were minimal (of course, past returns don’t always predict future performance). A 20-year time horizon would see a $1,000 investment grow to more than $3,000 by the end of 2020. Thirty years would produce a return of about $20,000. And across 40 years? A return on investment of more than $70,000.

Another reason the full extent of the cuts may be difficult to calculate for some time is that 2020 is the latest available year for which plan-reporting forms have been filed with the Department of Labor. Some institutions suspended or cut retirement contributions after the period analyzed by The Chronicle for this article. For instance, the University of Southern California didn’t anticipate suspending employer contributions until January 2021.

The full impact of the cuts, whatever it may be, will be felt by a large share of higher ed’s work force. According to federal statistics, 90 percent of employees at institutions of higher education have access to a retirement benefit, with 79 percent of all higher-ed employees participate in a plan.

Many of them were already anxious about how much money would be available to them in retirement. According to one 2020 survey, of those higher-ed employees contributing to a retirement plan, a quarter said they were not confident they could save enough.

Methodology

The Chronicle took a number of steps to accurately gauge pandemic-era changes in employer contributions to retirement plans sponsored by private nonprofit institutions of higher education.

Private institutions were featured exclusively in this analysis because it relied on records made public under the Employee Retirement Income Security Act of 1974, a federal law, known as Erisa, that sets minimum standards for most voluntarily established retirement and health plans in private industry. Erisa does not cover plans in the public sector.

All institutions in The Chronicle’s analysis appeared at least once in the annual compilations of the U.S. Department of Education’s Integrated Postsecondary Education Data System, though The Chronicle removed some entities from consideration. They included foundations and asset-holding companies that might be associated with colleges or universities but are legally distinct from them; hospitals and health systems; organizations that may have an educational function but whose purpose is largely distinct from academe (such as laboratories and religious entities); and organizations that in recent years converted from for-profit to nonprofit status, or attempted to do so.

Some institutions calculated and reported their activity on a fiscal-year schedule, while others did so on a calendar-year basis. The Chronicle limited its analysis to plans that spanned a full year — fiscal or calendar — and, to facilitate analysis, assigned a calendar-year designation to those that use a fiscal year.

To calculate the two-year change in contributions, The Chronicle analyzed the differences between the 2019 and 2020 calendar years, or the 2019-20 and 2020-21 fiscal years. The Chronicle’s analysis of contribution data over six years was limited to plans with publicly reported records available from 2015 to 2020.

The number of active participants at each institution used in the analysis was calculated by determining the median of the beginning and the ending headcount for each reporting period.

The Chronicle did not attempt to identify the precise cause of any modification that may have been made in each of the 1,175 retirement plans analyzed for this article. The pandemic could have been one of many reasons a plan’s contributions may have changed during this period.

[ad_2]

Source link