Manhattan Lease Signings Are Booming. Is It Enough for a Recovery?

[ad_1]

Like everything else in 2020, New York City’s real estate market was different than any in memory. A complete industry shutdown in March eventually led, by the end of the fourth quarter of 2020, to soaring median sale prices in Brooklyn (up 9.4 percent from Q4 2019) and Queens (up 9.5 percent). But Manhattan prices rose only marginally, largely driven by high-end condos. It’s the borough’s rental market that tells the story from a different angle.

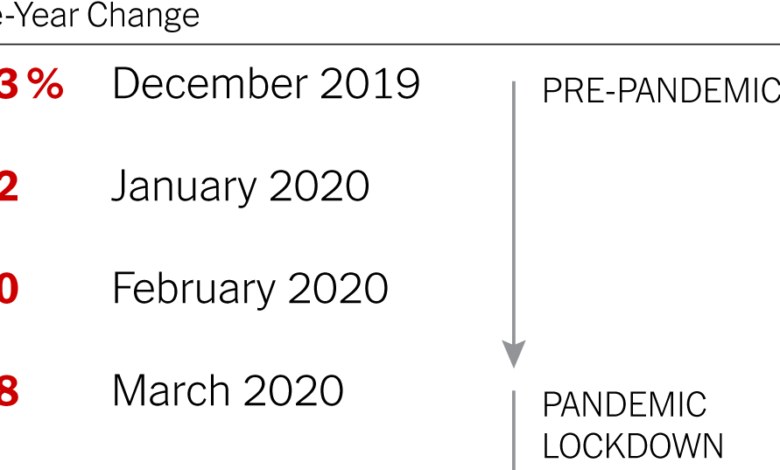

New lease signings in Manhattan, the subject of this week’s chart, fell 13 percent from December 2018 to December 2019, according to data provided by Jonathan Miller of the appraisal company Miller Samuel. Our chart follows signings over the next 12 months, with data provided by Mr. Miller, who helped us step through the numbers.

“The rental market was already going soft in December 2019,” said Mr. Miller, noting that rents had surpassed “a threshold of affordability” after years of increased expectations formed from bloated rents in new developments. When the pandemic hit, nothing had improved — March’s lease activity, 38 percent lower than a year earlier, was poor even considering the two weeks of shutdown. Lease signings dipped further through the spring, as Manhattanites seemed to be moving out, not in — escaping the city for suburban houses, childhood bedrooms or work-at-home rentals.

In June, as pandemic restrictions were being eased, broker fees were being waived and concessions were being widely applied, a summer rebound for rentals began. By September, lease-signing totals were matching the totals from a year earlier.

By fall and into winter, as the presidential election passed and coronavirus vaccines were developed, renters felt (a bit) more certainty about the future. By then, Manhattan’s median monthly rent, which had been falling through the pandemic, had landed at $2,800 — 17.3 percent lower than a year earlier. All this may have been enough to pull would-be renters off the fence and back into the market. The fourth quarter of 2020 saw the highest level of new lease signings in any Q4 in Manhattan since the 2008 financial crisis — 94 percent above where we started a year earlier.

Does this constitute a new normal for Manhattan renters?

“This is a baby step,” Mr. Miller said. “There are still record concessions, high inventory, record vacancies. Those indicators haven’t gone away. This is how a recovery begins, with new transactions, but this is not a recovery.”

For weekly email updates on residential real estate news, sign up here. Follow us on Twitter: @nytrealestate.

[ad_2]

Source link